Crypto assets rival real estate among Gen Z as homeownership becomes less achievable: Report

Young investors lean on social media for financial guidance over traditional sources.

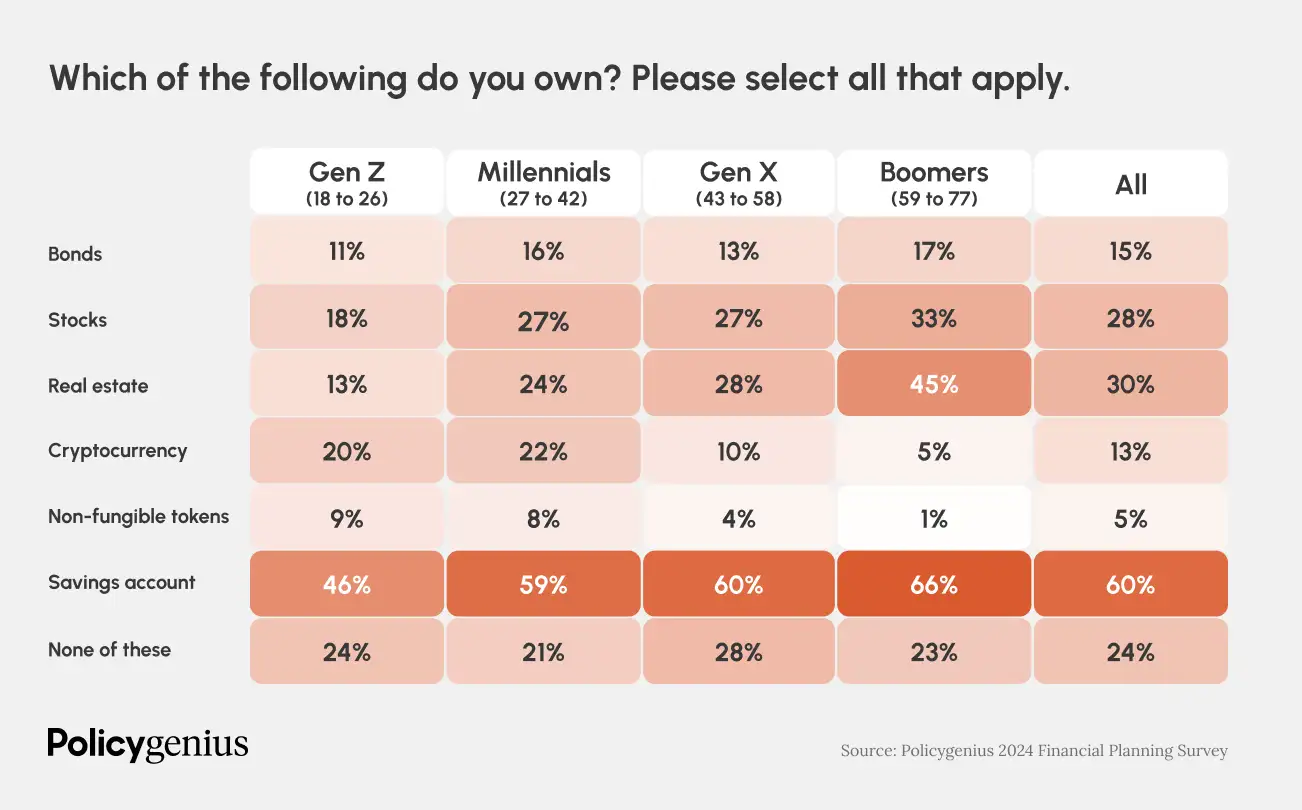

Investment preferences among generations are becoming increasingly distinct. A recent survey conducted by Policygenius and YouGov found that 20% of Gen Z (ages 18 to 26) own crypto, a figure that is notably higher than their ownership of stocks (18%), real estate (13%), and bonds (11%). Owning real estate is less common for younger generations due to affordability issues.

“Home affordability is at its lowest point since the Great Recession, as a combination of high interest rates, stagnating incomes, and low housing stock have put [homeownership] out of reach for many Americans,” said the survey.

According to the survey’s findings, millennials (ages 27 to 42) show a slightly higher propensity for investment, with 27% owning stocks and 22% owning crypto, while 24% have invested in real estate.

The data suggests that baby boomers continue to adhere to traditional investment patterns, with the highest ownership of stocks (33%) and real estate (45%). However, their engagement with crypto (5%) and NFTs (1%) is minimal, indicating a stark generational divide in the adoption of digital assets.

All generations value financial professionals, but older generations rely on them more, the survey reports. Compared to older generations, “Gen Z and millennials are more than twice as likely to turn to social media first with a financial question.” In contrast, only 2% of Gen X and baby boomers would consult social media first.

The survey further shows that 62% of millennials and Gen Zers have tried at least one financial “hack,” such as no-spend challenges or “infinite banking” (borrowing against a whole life insurance policy). These hacks, often popularized on social media, have seen significant engagement, with no-spend challenges amassing over 90 million views on TikTok.

The survey also explores the emotional aspect of financial management, revealing that 31% of baby boomers feel proud of how they manage their finances, a sentiment that is less prevalent among younger generations, with 23% of Gen Z expressing the same level of pride.

“This makes senses: Baby boomers are wealthier on average and more likely to own real estate than younger generations,” said the survey.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.