ETH Trust Fund scam: How $2 million vanished overnight

![]()

contributor

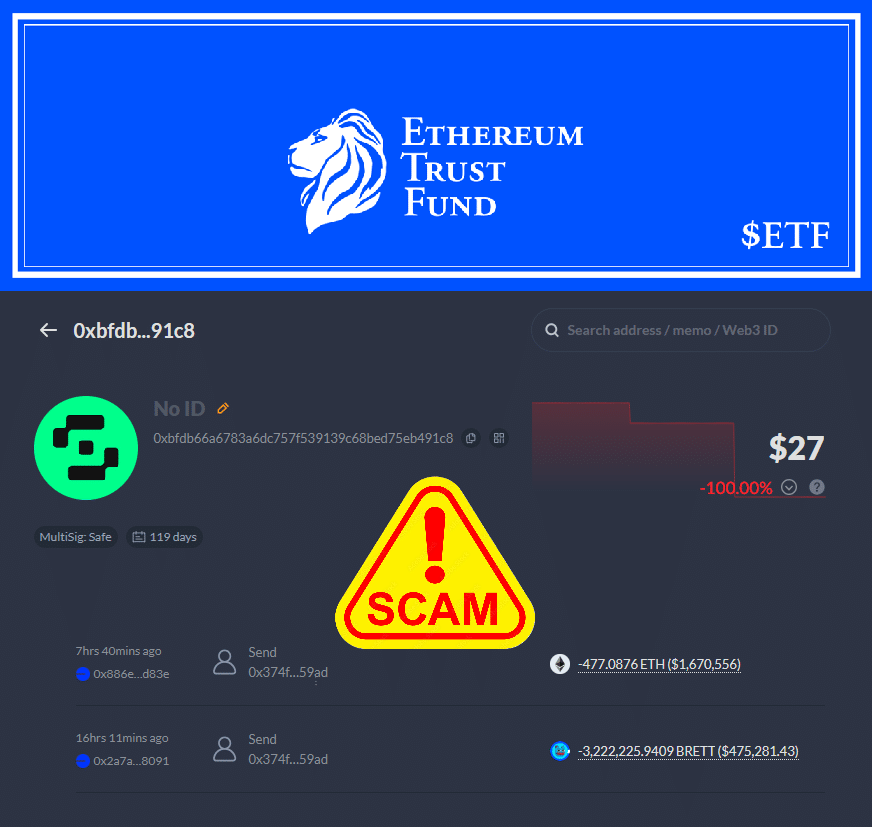

- ETH Trust Fund accused of a $2 million rug pull.

- Developers transfers funds and close social media accounts.

Another scandal again plagues the crypto world. In recent days, crypto crimes have been on the rise. Just days ago, Indian crypto exchange WazirX was hacked, and $230 million was stolen.

Within this worrying pattern, Ethereum [ETH] Trust Fund has rugged investors of $2 million.

ETH Trust Fund rug pull

ETH Trust Fund DAO (Decentralized Autonomous Organization) operates under the base network and is hitting the headline for stealing $2 million.

As reported by 0ctoshi through their X (formerly Twitter) page, the program was a scam and planned the exit stealing investors’ funds. Through their page, they reported that,

“Yesterday, the project known as ETHTrustFund (@ethtrustfund_now deleted) sent +$2M from the treasury to a new wallet; after months of intentional inactivity by the dev, it seems that he has decided to steal the funds.”

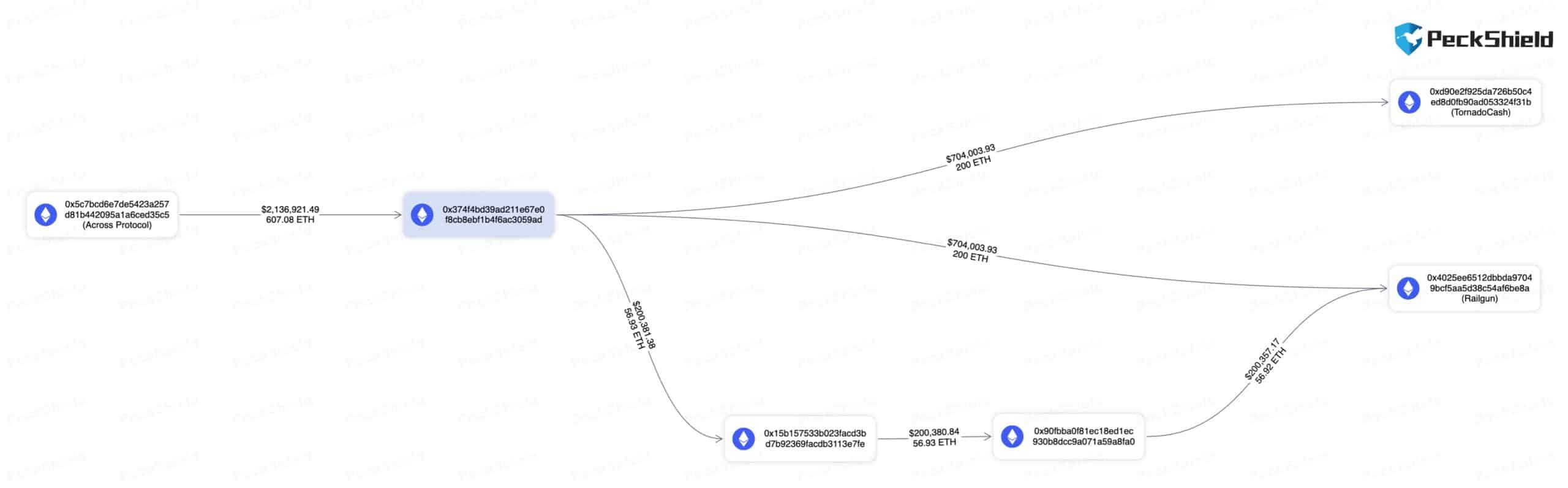

Security firm PeckShield further gave the report details. The firm explained that developers made transfers to a new wallet.

They further explained that mixer apps were used to hide their trail, thus facilitating their stealing process. Through their X page, PeckShield reported that,

“The scammers have already bridged the stolen funds to #Ethereum & laundered them via #Tornadocash & #Railgun.”

Following these transfers, the website went offline and deleted all social media accounts.

The details

The project represented itself to investors as an OHM fork that usually uses the base network community to capitalize on the interest.

Since its inception, the project has captured various investments as many crypto investors have shown substantial excitement towards memes and ETFs. As of this writing, the project has vanished and is yet to be traced.

Through the period of operation, it has tried to copy other successful projects such as Olympus and Wonderland. According to the reports, investors would get ETF tokens after staking their holdings through blockchain-based bonds.

The project targeted to take a different approach compared to other traditional rebaseDao. The project would debase tokens, thus increasing the value of tokens in supply and generating profits for investors.

Sadly, the project did not fulfill the goals with the development team led by Peng cutting all communications with the team three months ago.

Therefore, the recent transfers and close of all accounts were the end game developers hoped for as a perfect exit.