This Secret Loophole Makes Leasing an EV Better Than Buying Right Now

If you’re looking to social media to help you decide between leasing or buying an electric vehicle, don’t expect to find any definitive answers.

The question is a subject of fierce debate right now on social media platforms like Reddit. More than a hundred comments poured in after a user asked a question about buying versus leasing an electric vehicle. Some Reddit users voiced their strong opinions about buying an EV while others argued that leasing makes more sense. One pro-lease user pointed out that leasing can unlock the federal EV rebate more often than buying can. Others liked the idea of leasing their first EV to dip their toe into the EV-world before committing to a particular model long-term.

The fact that opinions range so widely on whether someone should lease or buy an EV doesn’t surprise experts in the auto industry. “That debate has [always] been present about cars, nevermind electric cars,” said Sean Tucker, lead editor for creative development at Kelley Blue Book by Cox Automotive.

Despite disagreements that flare up online, experts have a pretty definitive answer: Leasing an electric car right now is the better option for most people, compared to buying.

“You should lease an EV right now,” said Joseph Yoon, consumer insights analyst at Edmunds, an online shopping car site. “At this current point in time with EVs, it’s very prudent.”

One of the main reasons experts think leasing is the better option is because of a $7,500 federal EV tax credit. Only a small number of EVs qualify for the credit when you’re buying it, but more EVs qualify for the credit when you’re leasing. That’s due to a loophole in the tax code. As a buyer, you — or your EV of choice — may not qualify for the tax credit on an EV purchase, but you could reap the rewards as a lessee.

We did the math and compared leasing and buying. Here’s why experts say leasing often makes more sense.

Leasing an electric vehicle: Advantages and disadvantages

Leasing an EV isn’t much different than leasing any other type of vehicle. With a lease, you pay a small (or no) down payment up front, then commit to usually three years of monthly payments. At the end of the term, you return the car to the dealership.

This clearly differs from purchasing a vehicle. While a purchase still involves a down payment and monthly payments, once the vehicle is paid off, the buyer owns the car outright and they don’t return it.

“Even if you intend to buy, the best way to go about it is to start with a lease,” Yoon said. You can always buy the vehicle later on.

The EV tax credit loophole makes leasing an EV more attractive as well.

As an EV buyer, to qualify for the tax credit, you and your chosen EV must meet strict requirements involving where the EV’s battery materials are sourced and your income level. The restrictions, however, only apply if you’re purchasing an EV, but not if you’re leasing one, explains Tucker.

Under the Inflation Reduction Act, a business that purchases an electric car can qualify for the full $7,500 EV tax credit. The leasing agency purchases the EV from the manufacturer as a commercial sale, which, according to IRS tax code in Section 45W, bypasses the tax credit restrictions. The leasing agency can then pass the savings to you in a lease.

EV leasing pros

- Can unlock the federal $7,500 tax credit for vehicles that normally wouldn’t qualify as a purchase

- Leasing allows you to try out your first EV model without the commitment

- Upgrade to the latest EV more often

- Access to newer EVs with better battery range and other advanced features

EV leasing cons

- You don’t own the vehicle.

- You must return the vehicle or pay to buy it out from the dealership.

- Strong credit score needed to qualify for favorable lease terms

Buying an electric vehicle: Advantages and disadvantages

When you buy an electric vehicle, it can happen a few different ways. If you have the cash, you can pay for the vehicle in full, own it outright and walk away with no monthly payment. Or, if you’re like most people and need to finance it, you’d sign up for a loan, usually of about five or six years, to spread the price out in monthly payments.

When you’re buying an EV, it can potentially qualify for the $7,500 federal tax credit, but there are limits on income and vehicle price, plus some rules about where the car is manufactured.

“The price can come down significantly if it actually qualifies for that tax deduction,” Tucker said. And if you keep the car for as long as possible, you’ll get the financial benefit of that long-term investment, with no payments after the car is paid off.

But Yoon points out that, with high interest rates, you could get stuck with a steep monthly payment in a vehicle purchase. “There’s nothing going in your favor for financing,” he said. Plus, if you commit to a six-year car loan, the technology in your EV is going to rapidly become obsolete by the time you pay off the car, according to Yoon. For example, if the long-promised solid state batteries — which would double battery ranges in EVs — arrive on the scene, it could “drastically reduce the resale value of your EV,” Tucker said.

Pros for buying an EV

- Monthly payments end when you pay off the loan.

- You own it.

- Potential to take $7,500 off the sticker price (if you and the EV qualify)

Cons for buying an EV

- High interest rates can make an auto loan more expensive.

- Less EVs qualify for the federal tax credit when buying.

- EV technology might quickly outpace the vehicle you buy.

- Resale value can diminish faster with EVs

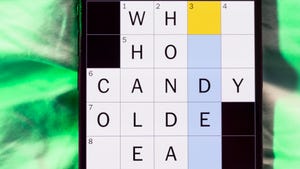

We do the math: Is buying cheaper than leasing an EV?

If you still need some hard numbers to help you decide, here’s a comparison of leasing versus buying a 2024 Tesla Model Y (MSRP $50,380).

We used Edmunds buying versus leasing calculator with the following criteria:

- The $7,500 tax credit applies for both buying and leasing

- The buyer or lessee has a good to excellent credit score

- A 48-month loan or lease

- No down payment

- 6% sales tax

-

Average of 12,000 miles driven per year

|

2024 Tesla Model Y (MSRP $50,380) |

Leasing |

Buying |

|

Minus the $7,500 Tax Credit |

$42,880 |

$42,880 |

|

Loan interest rate |

N/A |

5.4% |

|

Money factor or lease fee |

0.00225% |

— |

|

Sales tax |

$2,573 |

$2,573 |

|

Taxes, interest, fees |

$286 |

$3,537 |

|

Total cost |

$23,808 (*you don’t own) |

$45,453 (you’ll own) |

|

Monthly payment for a over 4 years four-year lease |

$496 |

$1,055 |

Which is better: Buying or leasing an electric vehicle?

For most people right now, leasing is a much better option than buying an EV due to the federal tax rebate. When buying (rather than leasing) an EV, it drastically reduces your chances of qualifying for the $7,500 discount.

“With leasing, none of that matters. There are no hoops, you just get all of it,” Yoon said. “It’s kind of a win-win.”

Leasing also offers other benefits. As EV technology improves rapidly, leasing allows for shorter terms, meaning you can upgrade your car more frequently. Plus, even if you can purchase an EV with the tax credit, steep interest rates hurt the financial picture.

“With the current interest rates, and from a technology future-proofing standpoint, it’s really hard for me to be like, I wholeheartedly recommend you to buy an EV,” Yoon said.

There are, of course, some people who might still choose to buy an EV. Tucker said this option appeals to people who like to drive their cars into the ground, and who might like the idea of not having a monthly payment once the loan is paid off.

“Leases usually come with mileage limits (around 10,000-12,000 miles per year and penalties for exceeding) that shoppers would need to consider. For most drivers, staying under the limit isn’t an issue, especially for EVs, but frequent road trippers or those with longer than average commutes will want to do some math,” said Antuan Goodwin, CNET’s 16-year auto and EV expert.

But in most cases, leasing is the more attractive option with little to no drawbacks, Yoon said.

FAQs

Who is leasing an EV best for?

Leasing is best for almost everyone right now, but especially for someone with a strong credit score. It’s also the best choice for someone who wants the most options for EVs that qualify for the federal tax credit, without limits based on vehicle cost or household income.

Who is buying an EV best for?

Buying an EV makes sense for someone who has the cash to buy a car outright, or who wants to commit to owning the car long-term to reap the financial benefits.