First Mover Americas: Bitcoin Pulls Back Before Probable Fed Rate Cut

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,822.90 -3.32%

Bitcoin (BTC): $58,779.97 -1.93%

Ether (ETH): $2,302.66 -4.24%

Nikkei 225: 36,581.76 -0.68%

Top Stories

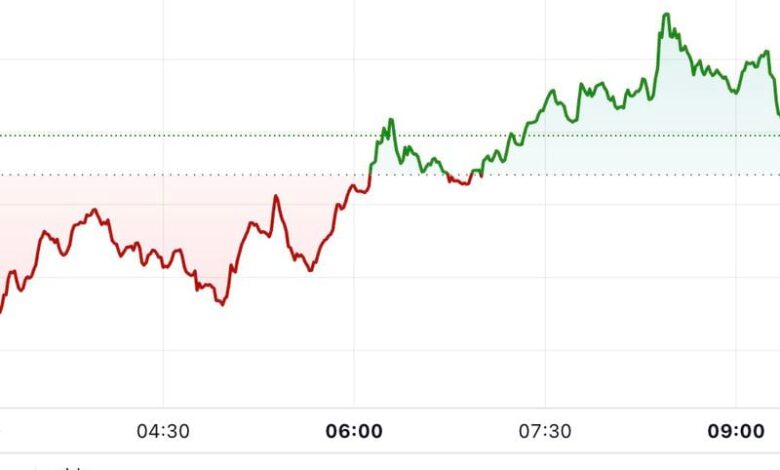

Bitcoin sank below $59,000 having spent much of the weekend above the $60,000 mark. BTC traded around $58,550 in the European morning, a drop of 2.4% over 24 hours at the start of a week in which traders worldwide expect the Federal Reserve to make its first interest-rate cut in more than four years. The broader digital asset market as measured by the CoinDesk 20 Index (CD20) is 3.6% lower. Crypto markets were buoyed by favorable U.S. economic data on Friday, which sparked a short-term rally. Bitcoin ETFs saw inflows of over $263 million, their highest since July 22, while the ether equivalents added around $1.5 million.

Ether led losses among major cryptocurrencies, sliding 4.5% in 24 hours. Cardano’s ADA fell 5% and Solana’s SOL declined 4%, while BNB Chain’s BNB was the best performer slipping just 1.1%. Futures traders betting on higher prices lost over $143 million amid the sudden drop, CoinGlass data shows. Elsewhere, the widely watched BTC/ETH ratio, which tracks the relative movements of the two largest tokens, fell to four-year lows. Ethereum as a protocol has had some serious competition in the last year with Solana looking to be the destination of choice to launch memecoins and new chains like Coinbase’s Base and Telegram-affiliated TON capturing more mindshare, which has probably hit demand for the Ethereum blockchain’s native token.

The Fed is widely expected to announce an interest-rate cut on Sept. 18, kicking off the so-called easing cycle. Traders, however, are split on the size of the cut, setting the stage for a potential volatility explosion in financial markets after the decision. At press time, the Fed funds futures showed a 41% chance of the Fed reducing rates by 25 basis points (bps) to the 5%-5.25% range and a 59% probability of a bigger 50 bps reduction to the 4.7%-5% range. The stalling of bitcoin’s upward momentum following its recovery from below $53,000 could be attributed to the uncertainty over the size of the impending rate cut.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/C4VXTVDKV5HMFMFN7WV7G745ZE.jpeg)

-

The chart illustrates how the last Fed rate-cutting cycle spurred a bitcoin surge to then all-time high levels around $70,000.

-

Its more recent bull market jump came after the Fed ceased increasing rates, since when BTC has trod water, seemingly awaiting the next rate-cutting cycle.

-

Source: Bloomberg, ETC Group

Trending Posts

Disclosure

Please note that our

and

do not sell my personal information

has been updated

.

CoinDesk is an

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

by the Bullish group, owner of

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.