A ‘silver tsunami’ won’t solve housing affordability challenges

Empty-nest households that could add to inventory aren’t where they’re needed most

- There is an oversupply of 12.8 million empty-nest homes.

- However, this potential supply is not located in the markets experiencing severe housing shortages.

- Pittsburgh, Buffalo, Cleveland, Detroit and New Orleans have the largest share of empty nest homes.

- The highest share of those homes are in Las Vegas, Austin, Los Angeles and Riverside.

, /PRNewswire/ — A “silver tsunami” — an expected flood of homes from older owners who will downsize or otherwise move on — has long been discussed as having the potential to relieve the nation’s shortage of housing. But new research from Zillow® shows these homes likely are located far from where they’re needed most.

“Even if we did see a ‘silver tsunami,’ a look at the map tells me it wouldn’t really move the needle in terms of solving our housing affordability crunch,” said Orphe Divounguy, Zillow senior economist. “These empty-nest households are concentrated in more affordable markets, where housing is already more accessible — not in the expensive coastal job centers where young workers are moving and where more homes are most desperately needed.”

In 2022, there were roughly 20.9 million empty-nest households nationwide — residents ages 55 or older who have lived in the same home for 10 or more years, have no children at home and have at least two extra bedrooms. That’s compared to the 8.1 million families living with nonrelatives in 2022 that were likely in need of their own place. But the supply and the demand don’t match up on the map.

Empty-nest households are not where most young workers choose to live

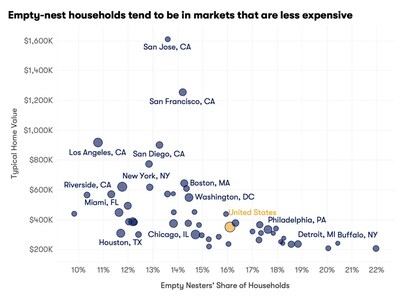

Empty-nest households tend to be in markets that are less expensive. Among the 50 largest U.S. metros, Pittsburgh had the highest share of empty-nest households at 22%, followed by Buffalo (20%), Cleveland (20%), Detroit (19%), St. Louis (19%) and New Orleans (18%). These markets are already accessible — all but New Orleans are among the top 10 markets with homes on the market that are affordable. They also have relatively low shares of heads of households younger than age 44.

On the other hand, metros with some of the largest shares of millennials and Gen Zers moving in are among the nation’s most expensive. Markets where the largest share of recently moved households with members 44 and younger are San Jose (35%), Austin (32%) and Denver (32%). Seattle and Portland are also among the top 10, each with 30%. Housing affordability in these metros is far more challenging than at the national level, and all of them have a smaller share of empty-nest households than the national average.

As a result, the impact of a future increase in supply coming from the existing housing stock owned by older individuals would likely have a smaller impact on affordability in expensive, high-demand coastal markets.

Rather, the primary fix for affordability challenges remains a strong supply expansion coming from newly built homes. Zillow research shows that housing shortages were the most severe in markets with more land-use restrictions. Along with promoting denser construction, removing barriers to homeownership that aren’t related to monthly income — such as credit assistance programs, down payment assistance or help with closing costs — would likely improve access to homeownership.

|

Metro Area* |

Zillow Home |

Empty |

Under-44 |

Recent Under- |

Share of Listings |

|

United States |

$360,385 |

16 % |

35 % |

25 % |

27 % |

|

New York, NY |

$677,399 |

12 % |

33 % |

23 % |

11 % |

|

Los Angeles, CA |

$956,186 |

11 % |

35 % |

24 % |

2 % |

|

Chicago, IL |

$324,456 |

15 % |

36 % |

26 % |

43 % |

|

Dallas, TX |

$369,778 |

12 % |

42 % |

28 % |

28 % |

|

Houston, TX |

$305,162 |

12 % |

41 % |

29 % |

40 % |

|

Washington, DC |

$568,429 |

14 % |

38 % |

29 % |

44 % |

|

Philadelphia, PA |

$364,548 |

18 % |

35 % |

23 % |

51 % |

|

Miami, FL |

$486,379 |

12 % |

30 % |

27 % |

24 % |

|

Atlanta, GA |

$378,130 |

14 % |

38 % |

25 % |

46 % |

|

Boston, MA |

$693,105 |

14 % |

35 % |

28 % |

12 % |

|

Phoenix, AZ |

$453,853 |

12 % |

38 % |

26 % |

24 % |

|

San Francisco, CA |

$1,141,068 |

14 % |

36 % |

28 % |

14 % |

|

Riverside, CA |

$579,529 |

11 % |

35 % |

18 % |

13 % |

|

Detroit, MI |

$253,014 |

19 % |

32 % |

22 % |

61 % |

|

Seattle, WA |

$739,858 |

13 % |

43 % |

30 % |

17 % |

|

Minneapolis, MN |

$374,394 |

16 % |

39 % |

26 % |

51 % |

|

San Diego, CA |

$936,358 |

13 % |

39 % |

25 % |

4 % |

|

Tampa, FL |

$371,922 |

12 % |

32 % |

26 % |

26 % |

|

Denver, CO |

$578,673 |

13 % |

43 % |

32 % |

23 % |

|

Baltimore, MD |

$386,089 |

17 % |

35 % |

24 % |

56 % |

|

St. Louis, MO |

$252,506 |

19 % |

36 % |

21 % |

64 % |

|

Orlando, FL |

$393,519 |

12 % |

38 % |

28 % |

22 % |

|

Charlotte, NC |

$378,960 |

14 % |

38 % |

25 % |

33 % |

|

San Antonio, TX |

$281,156 |

12 % |

41 % |

30 % |

33 % |

|

Portland, OR |

$545,148 |

14 % |

38 % |

30 % |

18 % |

|

Sacramento, CA |

$577,374 |

14 % |

35 % |

23 % |

11 % |

|

Pittsburgh, PA |

$214,195 |

22 % |

32 % |

22 % |

72 % |

|

Cincinnati, OH |

$285,081 |

17 % |

37 % |

23 % |

53 % |

|

Austin, TX |

$446,524 |

10 % |

48 % |

32 % |

26 % |

|

Las Vegas, NV |

$431,864 |

10 % |

37 % |

24 % |

19 % |

|

Kansas City, MO |

$303,007 |

16 % |

38 % |

28 % |

51 % |

|

Columbus, OH |

$312,529 |

15 % |

41 % |

26 % |

45 % |

|

Indianapolis, IN |

$279,039 |

15 % |

41 % |

24 % |

59 % |

|

Cleveland, OH |

$231,573 |

20 % |

33 % |

28 % |

57 % |

|

San Jose, CA |

$1,595,389 |

14 % |

38 % |

35 % |

7 % |

|

Nashville, TN |

$438,346 |

14 % |

42 % |

28 % |

19 % |

|

Virginia Beach, VA |

$350,756 |

17 % |

39 % |

28 % |

44 % |

|

Providence, RI |

$488,346 |

16 % |

32 % |

22 % |

15 % |

|

Jacksonville, FL |

$354,943 |

15 % |

37 % |

26 % |

40 % |

|

Milwaukee, WI |

$344,445 |

17 % |

37 % |

25 % |

46 % |

|

Oklahoma City, OK |

$233,754 |

15 % |

42 % |

31 % |

43 % |

|

Raleigh, NC |

$440,100 |

15 % |

39 % |

24 % |

40 % |

|

Memphis, TN |

$237,679 |

16 % |

37 % |

25 % |

48 % |

|

Richmond, VA |

$368,330 |

18 % |

36 % |

26 % |

43 % |

|

Louisville, KY |

$259,892 |

18 % |

35 % |

24 % |

48 % |

|

New Orleans, LA |

$240,909 |

18 % |

34 % |

24 % |

37 % |

|

Salt Lake City, UT |

$545,457 |

14 % |

45 % |

25 % |

23 % |

|

Hartford, CT |

$362,743 |

18 % |

33 % |

25 % |

42 % |

|

Buffalo, NY |

$263,076 |

20 % |

33 % |

19 % |

64 % |

|

Birmingham, AL |

$249,786 |

18 % |

36 % |

26 % |

55 % |

*Table ordered by market size

About Zillow Group:

Zillow Group, Inc. (Nasdaq: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing, and renting experiences.

Zillow Group’s affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Zillow Rentals®, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce®, and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2024 MFTB Holdco, Inc., a Zillow affiliate.

(ZFIN)

SOURCE Zillow