Updated: Blackstone Triggers Hipgnosis Takeover Battle by Outbidding Concord With $1.5 Billion Offer

In a dramatic turn of events, private equity giant Blackstone has upped the ante in the battle to control the troubled Hipgnosis Songs Fund. Here’s a breakdown of what Blackstone is putting on the table — and what’s potentially next.

The following story has been updated on Sunday, April 21st to reflect a response to Blackstone’s bid from Hipgnosis Songs Fund (see below).

Blackstone issued a detailed statement to Digital Music News on Saturday (April 20th) outlining its $1.5 billion takeover bid, which outpaces Nashville-based Concord Chorus’s recently-tendered $1.4 billion offer. Digital Music News first reported that offer late Wednesday, April 17th, prompting a 30.5% bounce in Hipgnosis shares the following day.

For battered Hipgnosis shareholders, Concord’s $1.4 billion offer was a splash of relief. But now, there’s something better. Blackstone’s all-cash offer would give Hipgnosis shareholders $1.24 per share, which cleanly beats Concord’s $1.14 per share proposition.

Blackstone’s weekend bid represents an 8.7% premium over Hipgnosis’s closing share price on the previous trading day, making Blackstone’s offer substantially more attractive for shareholders seeking to recoup losses and get out.

Update (Sunday, April 21st): Hipgnosis Songs Fund Limited has now positively responded to Blackstone’s bid. In a statement emailed early Sunday to Digital Music News, the Fund acknowledged the bid and stated that it would recommend the offer to shareholders.

“The Board, having reviewed the Proposal with its financial adviser, Singer Capital Markets, has indicated to Blackstone that the Proposal is at a value that it would be minded to recommend to its shareholders should Blackstone announce a firm intention to make an offer pursuant to Rule 2.7 of the Code on such financial terms,” the statement assured.

“The Board and its advisers will continue to provide Blackstone and its advisers access to confirmatory due diligence, to enable Blackstone to announce a firm intention to make an offer, as soon as possible.”

The counter-bid signals that Blackstone is eyeing a strategic consolidation play.

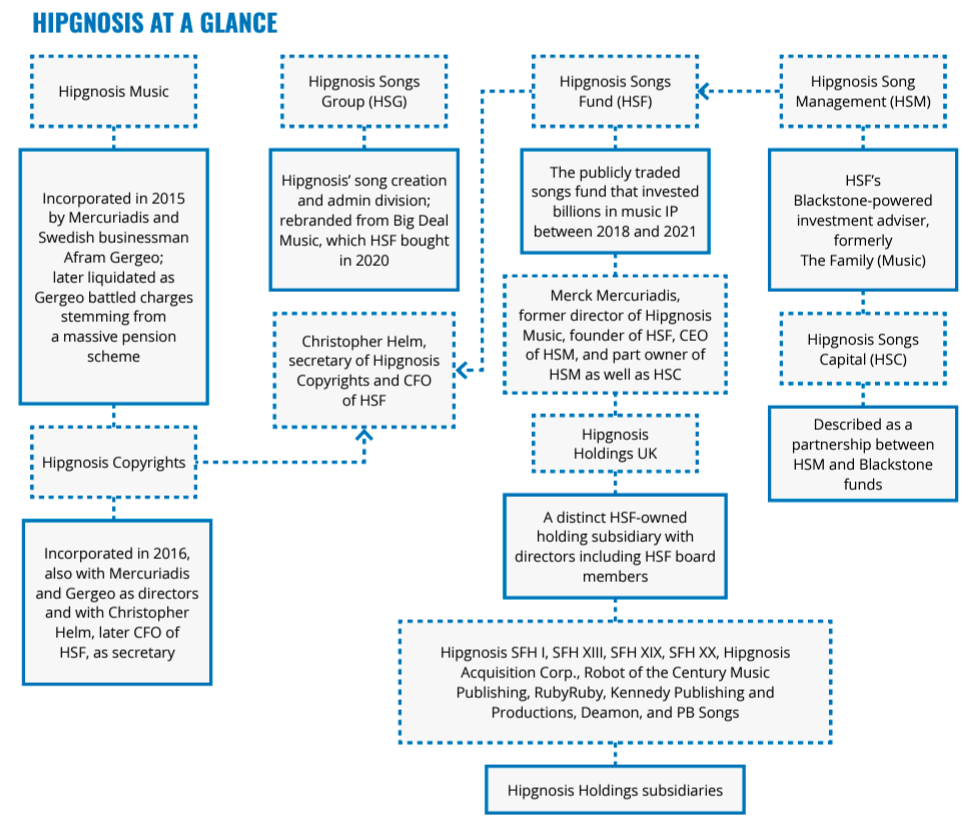

Blackstone’s determination to acquire Hipgnosis Songs Fund underscores its vested interest in the music rights market. As detailed previously, the private equity firm already owns two key entities within the Hipgnosis family: Hipgnosis Songs Capital (the private music assets investment fund) and Hipgnosis Song Investment (the investment advisor).

In that context, Blackstone’s latest bid indicates a strong desire to consolidate its power in the music rights industry.

And make no mistake: the competitive bidding from Blackstone and Concord also highlights the potential value seen within Hipgnosis’s music royalty assets despite the fund’s recent difficulties.

Indeed, Hipgnosis has been plagued by accounting errors, internal disputes, declining net value, and slashed shareholder dividends. Investor confidence has been battered, though it’s easy to forget how valuable Hipgnosis’ catalog remains. Indeed, this disparity offers a prime opportunity for prospective buyers to acquire a goldmine of song rights, including hits by artists like Neil Young, Journey, Lindsey Buckingham, and Blondie.

An overview of the many Hipgnosis entities and their connections to one another (Source: Digital Music News and DMN Pro).

Then there’s the issue of Hipgnosis Song Management and the music industry’s punching bag du jour, Merck Mercuriadis.

Blackstone’s takeover battle is complicated by a contractual option held by Blackstone’s Hipgnosis Song Management, which advises the public and private Hipgnosis funds. This option grants them the right to outbid rivals and potentially take the assets private.

The option was designed to assure artists and songwriters (who either remain partial owners or are now ex-owners) that their catalogs would only change hands with appropriate oversight and controls. That helped to secure juicy deals and buy-in, though it has proven to be an obstacle in the board’s attempts to secure external bids.

Of course, lingering in the background is Merck Mercuriadis, whose swashbuckling vision has created one of the world’s most valuable tranches of music IP. But ‘Merck’ has also been chided for wildly overbidding for valuable catalogs and setting the stage for a crash once the Fed hiked interest rates.

So far, Merck has remained quiet following the Concord bid, though he’s undoubtedly pushing buttons in the background.

Either way, Blackstone’s bid is better — though arguably still a sweetheart deal given the longer-term potential of Hipgnosis’ asset tranche.

In their offer, Blackstone clearly states their position: “[We] strongly encourage the board of Hipgnosis to recognize the significant increase in value available to all shareholders under the terms of its Fourth Proposal, over the $1.16 as set out in the Concord Offer, and to work with Blackstone to reach agreement on a unanimously recommended Firm Offer in an expeditious manner.”

Recognize the increase they will — though something tells us this isn’t the last and final offer for Hipgnosis. Stay tuned.

Got a tip? Send it confidentially to Digital Music News via Signal — our handle is digitalmusicnews.07.