ANZ – WES Elliott Wave analysis [Video]

![ANZ – WES Elliott Wave analysis [Video]](https://us-news.us/wp-content/uploads/2024/10/60276-anz-wes-elliott-wave-analysis-video-750x470.jpg)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with ANZ GROUP HOLDINGS LIMITED – ANZ – WES. We see ANZ pushing lower in the near term, and there is weakness in the bull market trend.

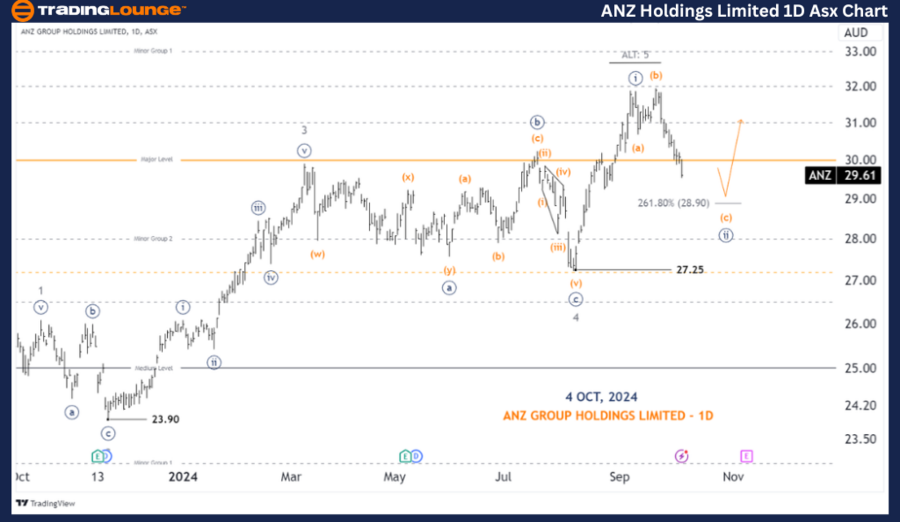

ASX: ANZ GROUP HOLDINGS LIMITED – ANZ – WES one day chart (Semilog scale) analysis

Function: Major trend (Minute degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave (c)-orange of Wave ((ii))-navy of Wave 5-grey.

Details: Wave 5-grey may be unfolding to push higher, or it may have ended. So in either case, price will continue to push lower, aiming for the nearest target around 28.90. A further break of 27.25 would trigger the ALT alternative scenario, further indicating that the entire five-waves have ended with wave 5-grey, and a Big Correction is unfolding to push significantly lower.

Invalidation point: 27.25.

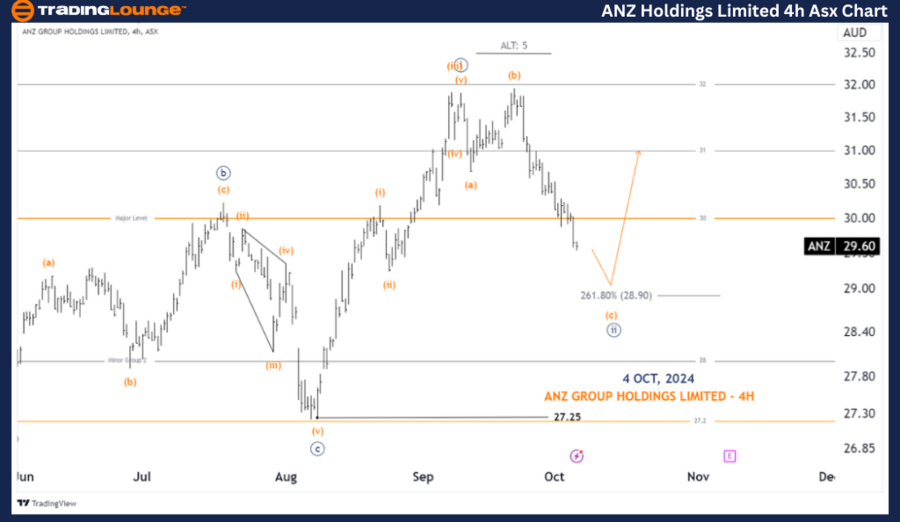

ASX: ANZ GROUP HOLDINGS LIMITED – ANZ – WES four-hour chart analysis

Function: Major trend (Minute degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave (c)-orange of Wave ((ii))-navy.

Details: Wave ((ii))-navy will continue to push lower, it is developing as an Expanded Flat, and is targeting a low of 28.90. A break of this level will continue lower, and a break of 27.25 will trigger the alternative scenario that the 5-grey wave is actually over, and ANZ will push significantly lower.

Invalidation point: 27.25.

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: ANZ GROUP HOLDINGS LIMITED – ANZ – WES aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

ASX: ANZ GROUP HOLDINGS LIMITED – ANZ – WES four-hour chart analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.