Bitcoin ETFs amass $7.7 billion in trading volume, registering a new daily record

While Bitcoin surpasses $60,000, spot Bitcoin ETFs traded in the US register a trading frenzy.

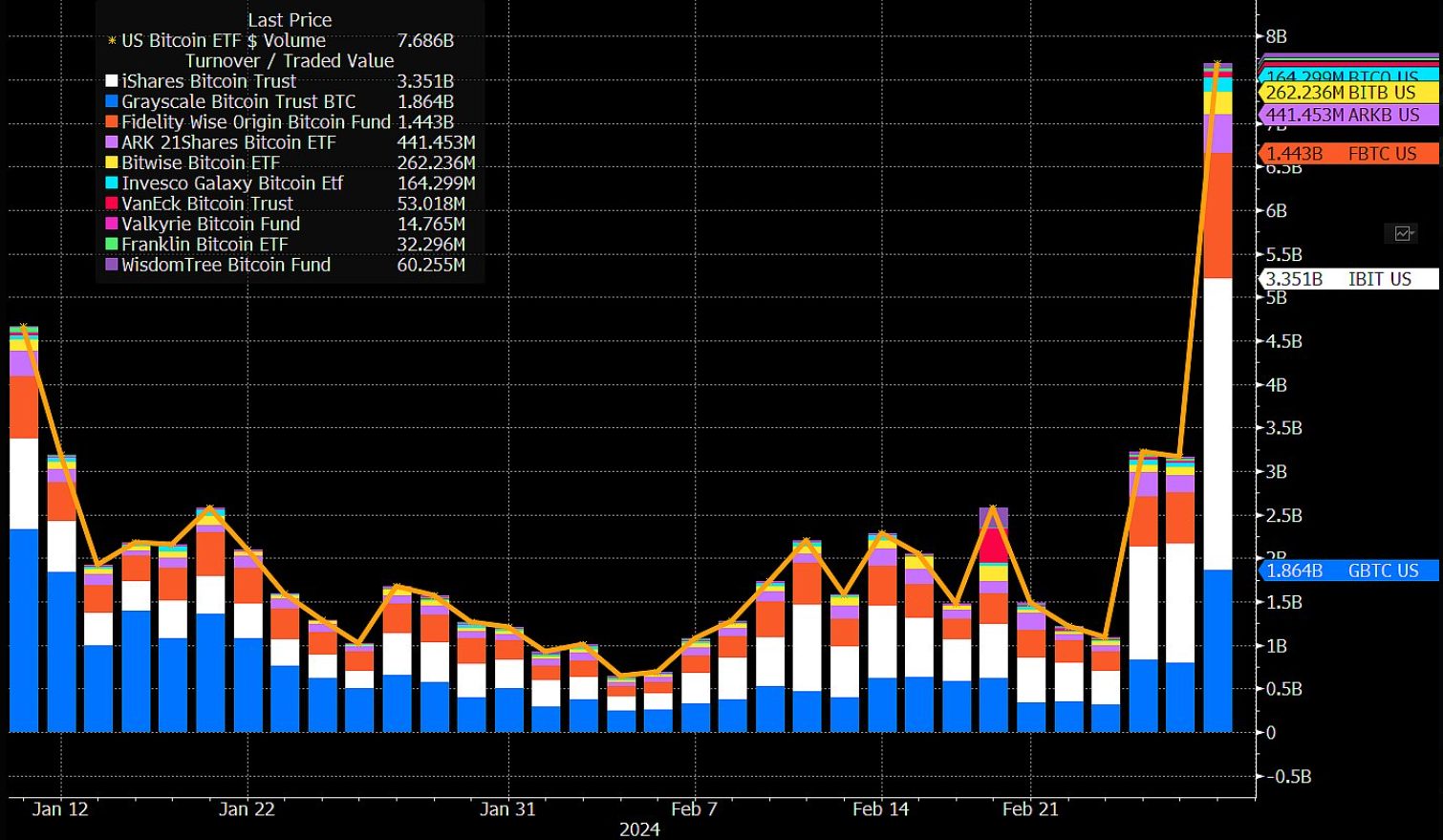

Spot Bitcoin exchange-traded funds (ETFs) in the US registered a daily trading volume of $7.69 billion this Wednesday, surpassing the previous record of $4.66 billion by 65%. Bloomberg analyst James Seyffart pointed out that those numbers could go higher, as some additional data from the ETFs flows later.

Eric Balchunas, also a Bloomberg analyst, shared on an X post that the “trading explosion” had flowed to Bitcoin futures ETFs as well. He mentioned BITX, which registered a new trading record with three more hours until the trading session ended.

In another X post, Balchunas added that through conversations with market makers, the volume spike today was largely caused by natural demand versus arbitrage volume. Another piece of information shared by Bloomberg’s analyst is that wirehouses are looking to add Bitcoin ETFs soon.

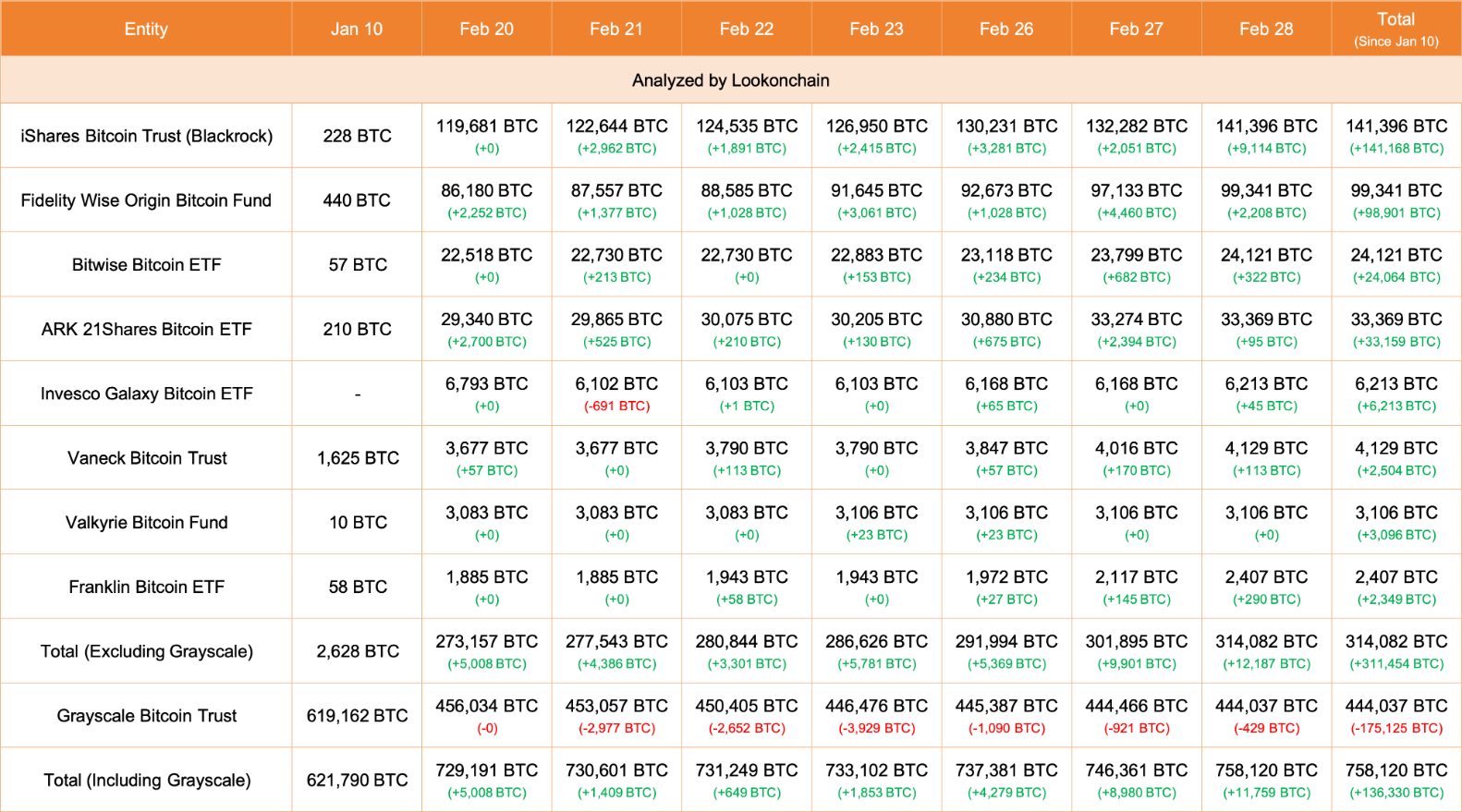

The profile Lookonchain updated the growth in ETF managers’ Bitcoin holdings, highlighting an 11,759 BTC leap in flow. The outflow for Grayscale’s GBTC was the smallest of the last six days, with just 429 BTC leaving the fund.

Moreover, four spot Bitcoin ETFs in the US now hold more than $2 billion in Bitcoin, after ARK Invest’s ARKB added more BTC to its address. The other three ETFs are BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.