Case-Shiller Index

What does the data show?

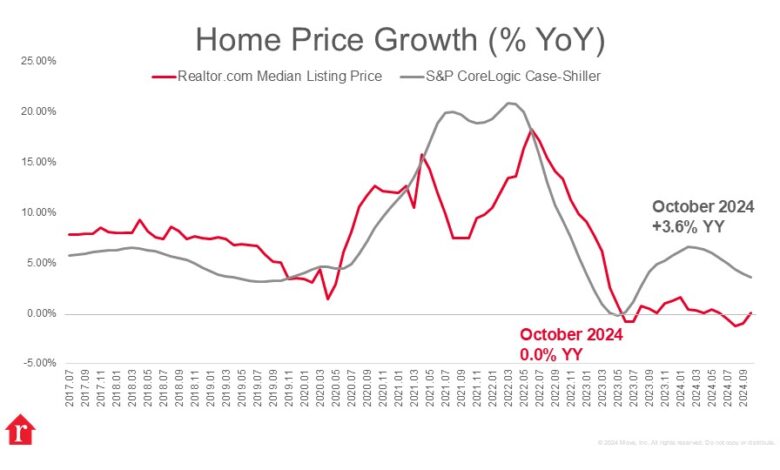

The S&P CoreLogic Case-Shiller Index showed that home sales prices climbed 4.1% through the first month of the year. The 10- and 20-city indices also increased, ticking up 5.3% and 4.7%. All three indices showed accelerating price growth relative to the previous month. This month’s release covers home sales in November, December, and January, a period in which buyers enjoyed growing inventory, but had to contend with climbing mortgage rates. Mortgage rates reached a recent peak of 7.04% in January, their highest level since May 2024. Rates have since leveled out in the 6.6% to 6.7% range, offering buyers a small amount of relief as the spring homebuying season kicks off.

How did trends vary by region?

As the country as a whole faces tight inventory levels, regional variation in the housing market means that the impact varies geographically. Buyers face vastly different market conditions depending on their region, as discussed in the recent Housing Supply Gap report. Relatively strong construction activity in the South and West have helped take some pressure off of home prices. However, the Northeast and Midwest continue to see demand significantly outstrip supply, which has led to more considerable price growth in the regions. In line with these trends, New York once again reported the highest price growth (+7.7%), followed by Chicago (+7.5%) and Boston (+6.6%). Tampa once again saw falling prices in the month, down 1.5%.

What is ahead for housing?

Going off of typical seasonal trends, the Best Time To Sell a home is right around the corner, the week of April 13. Economic uncertainty could present a hurdle to this spring’s market as both sellers and buyers proceed with caution. Nevertheless, the recent downward mortgage rate trend and building inventory could present opportunities for buyers who have been waiting for their moment to take the leap.