ETFSwap ($ETFS) Emerges As The Best Bet As Bitcoin ETF AuM Climb To $58 Billion

There’s no denying the fact that Spot Bitcoin ETFs are the hottest topic in the crypto industry right now. Investor enthusiasm surrounding the various applications, approvals, and launch of Spot Bitcoin ETFs in the US has led to a major influx of new capital into the crypto industry.

Interest in cryptocurrencies, particularly Bitcoin (BTC), has skyrocketed, as the ETFs are now an exciting way for traditional market investors to gain exposure to the asset without actually having to buy and trade it themselves.

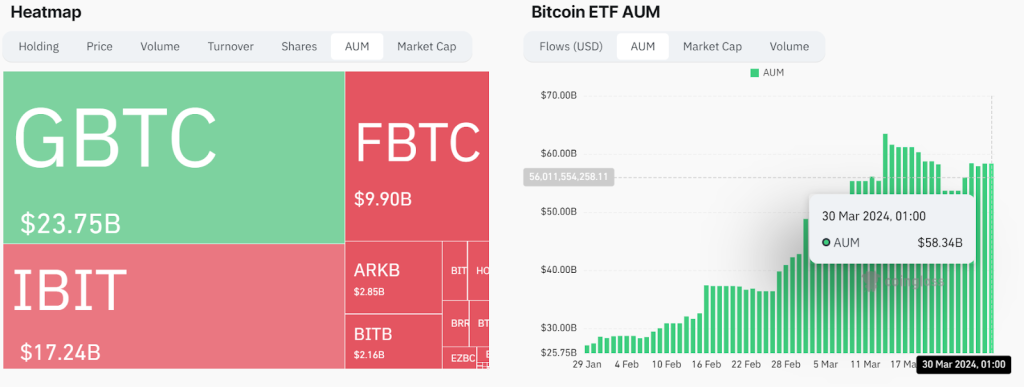

As a result, the total Assets under Management (AuM) of these Spot Bitcoin (BTC) ETFs have surged with record values. According to data from Glassnode, the ETFs now have a combined AuM of $58.34 billion at the time of writing.

Although ETFs are now a common phenomenon in the crypto industry, their exposure remains limited to a few cryptocurrencies and ETFs. Nevertheless, there is a growing demand for a more extensive connection between the traditional exchange-traded fund (ETF) market and decentralized finance (DeFi), and this is where ETFSwap ($ETFS) comes into play.

What Is ETFSwap ($ETFS)?

ETFSwap’s mission is to serve as a decentralized platform that opens up ETFs to a large investor base that would otherwise be difficult to access. The platform leverages blockchain technology to provide transparent and efficient means for the trading of ETFs from different industries.

ETFSwap’s model is pretty straightforward for the investment of exchange-traded funds. Equipped with a comprehensive ETF marketplace, ETFSwap ($ETFS) will serve as a home to a vast number of ETFs that have been onboarded (tokenized) to the blockchain.

These tokenized ETFs will track the performance of crypto ETFs from leading institutions like Blackrock’s IBIT, which now boasts $17.24 billion worth of assets under management. Additionally, ETFSwap will also provide exposure to commodity ETFs like gold and fixed-income ETFs like bonds, treasuries, etc.

Since ETFSwap is built on decentralized finance (DeFi) protocols, users will be able to sign up without KYC requirements and trade its ETF offerings 24/7 with low fees and without a centralized intermediary.

Unlike traditional investment in ETFs, ETFSwap will allow its users to swap and trade its various ETF offerings with leverages of up to 10x in order to potentially amplify their gains. The platform will also provide fractional ownership, allowing its users to diversify their portfolios.

ETFSwap’s decentralized ecosystem is home to ETFS, an ERC20 token that connects its holders to a vast number of advanced features on the platform. With ETFS, holders are able to enjoy discounted trading fees, a share of the platform’s revenue, governance rights, and access to events and promotions, amongst other benefits.

The Next Big Thing In Crypto After Bitcoin

Overall, ETFSwap ($ETFS) shows DeFi’s promise to make financial products more accessible, especially with the growing popularity of crypto ETFs. By bringing the growing $58 billion US Spot Bitcoin (BTC) ETF market and other investing niches on-chain, ETFSwap ($ETFS) can attract more traders to DeFi and increase mainstream crypto adoption.

The platform’s potential seems to be attracting investors, as ETFSwap ($ETFS) has already raised $650,000 in a private sale round with just two institutional investors. Following this, the presale rounds of $ETFS are now active, with stage 1 going on for $0.00854 per token with limited tokens available.

Stage 2’s presale price will be at a higher price of $0.01831 per token, already guaranteeing a profit for stage 1 investors. As such, now is the best time to get in on the highly undervalued price in the first presale round.

For more information about the $ETFS Presale:

Disclaimer and Risk Warning

This is a press release post. Coinpedia does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. The image used in this article is for informational purposes only and is provided to us by a third party. Coinpedia should not be held responsible for image copyright issues. Contact us if you have any issues or concerns. Readers should do their research before taking any actions related to the company.

Was this writing helpful?

No Yes

PR Manager

Press release about recent ICOs, announcement from startups, new cryptocurrency launch by firms and unlike.