Here’s Why A Ruling On Biden’s SAVE Plan May Affect Other Student Loans

Topline

The 8th Circuit Court of Appeals declined to clarify a recent ruling that blocked President Joe Biden’s SAVE student loan plan—which is a newly launched income-driven repayment plan that lowers the percent of monthly income borrowers pay—leading some to worry that other student loan forgiveness may also be blocked by the unclear ruling.

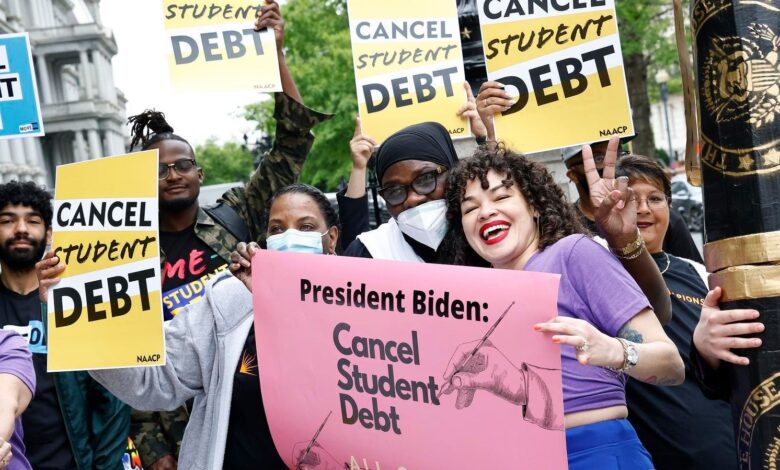

The 8th Circuit Court of Appeals declined to clarify its recent ruling that blocked President Joe … [+] Biden’s SAVE plan for student loans, leading to concerns the ruling could impact other loan forgiveness plans.

Key Facts

The court Monday shot down a request from the Education Department to clarify its Aug. 9 ruling, which effectively blocked the SAVE Plan from moving forward after Republican-led states sued to block the entirety of the SAVE Plan.

The court was broad in the Aug. 9 ruling, saying the government is barred from providing “any further forgiveness of principal or interest” for loans covered by income-driven repayment rules or the Federal Family Education Loan (FFEL) program, prompting questions of how it could affect other loan programs.

This was a more extreme ruling than past injunctions, which had just blocked elements of the plan from being implemented.

That ruling led Biden and the Education Department to request the 8th Circuit Court clarify the scope of its ruling “to avoid further disruption of student loan programs unrelated to this litigation.”

The Education Department’s request said the injunction could be understood to ban other forgiveness, including forgiveness offered through income-based repayment plans, public loan forgiveness or previously existing income-contingent repayment plans that are not being challenged—and sought clarification on whether those were still protected.

In response to the request, the court issued a one sentence response that read: “The motion to clarify is denied,” furthering the concern around non-SAVE payment plans.

Get Forbes Breaking News Text Alerts: We’re launching text message alerts so you’ll always know the biggest stories shaping the day’s headlines. Text “Alerts” to (201) 335-0739 or sign up here.

What To Watch For

How Biden and the Education Department respond to the court’s refusal to clarify. The injunction they were seeking clarification on is set to remain in effect until either the 8th Circuit Court rules on it again or the Supreme Court rules on it. Before the refusal to clarify, the Department had already filed an emergency request with the Supreme Court to vacate the 8th Circuit’s ruling, saying if it’s allowed to stand, it could “harm borrowers who have dutifully repaid their loans for up to 25 years by denying forgiveness that has been available under law for three decades.”

Key Background

Biden’s Saving on a Valuable Education (SAVE) Plan has faced opposition since it was announced last year after the Supreme Court blocked Biden’s previous attempt to cancel many loans altogether. Republicans sued the administration over the plan, which allows borrowers’ debts to be forgiven sooner and for more borrowers to have monthly payments of $0, and have criticized it as exceeding Biden’s authority as president. One suit filed in Kansas by a number of states and one filed in Missouri argued the sweeping relief proposed in the plan is “unlawful” and said it imposes a financial burden on the states.

Big Number

30 million. That’s how many borrowers Biden estimated the SAVE plan could help when he announced it last August. More than 8 million had enrolled as of July.

Tangent

After the Aug. 9 ruling, the Department of Education said while the lawsuits against the SAVE plan play out, borrowers enrolled in it are in forbearance, meaning their payments can be paused and they won’t accrue interest. Time in forbearance also won’t count toward loan forgiveness.

Further Reading

ForbesCourt Issues Yet Another Blow To Student Loan Forgiveness As Appeals ContinueBy Adam S. MinskyForbesWhat Borrowers Should Know As Biden’s Student Loan Forgiveness Goes To Supreme Court—AgainBy Alison Durkee