Hindenburg report on SEBI chief: Opposition parties rally for answers

Congress leader and member of Parliament (MP), Jairam Ramesh, revived the demand for a probe by a Joint Parliamentary Committee in the wake of the latest allegations. Mahua Moitra accused the Modi government of crony capitalism. Read on to see other reactions.

By CNBCTV18.com August 11, 2024, 12:43:49 AM IST (Published)

By CNBCTV18.com August 11, 2024, 12:43:49 AM IST (Published)

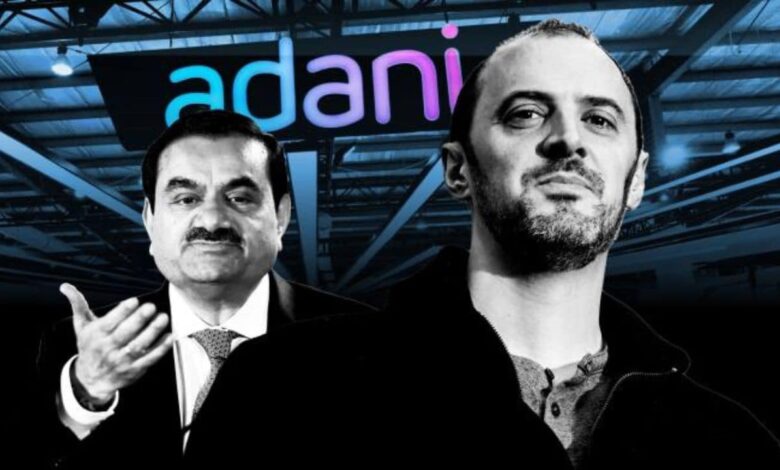

The latest report from Hindenburg insinuating a conflict of interest in the investigation into the alleged rigging of Adani Group stocks via offshore funds has given the opposition parties fresh ammunition against the ruling government under Prime Minister Narendra Modi.

Citing whistleblower documents, the US-based shortseller has accused Madhabi Puri Buch, the chief of Securities and Exchange Board of India (SEBI), and her husband Dhaval Buch, of having stakes in offshore funds that were invested in the Adani Group. You can read the highlights from the latest Hindenburg report here.

Congress leader and member of Parliament (MP), Jairam Ramesh, revived the demand for a probe by a Joint Parliamentary Committee in the wake of the latest allegations.

— Jairam Ramesh (@Jairam_Ramesh) August 10, 2024

“In true Adani style – even SEBI Chairman is investor in his group. Crony Capitalism at its finest,” said Trinamool Congress MP Mahua Moitra in a social media post, demanding a probe by the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED), into alleged money laundering.

The 62-year-old Gautam Adani who is at the centre of the latest storm is widely believed to be close to the ruling establishment in India. In January 2023, Hindenburg, the US-based shortseller accused the Indian billionaire of using offshore funds to inflate the prices of his group stocks.

While Adani denied the charges, the case went up to the Supreme Court, which chose to place its faith on the market regulator SEBI to conduct a fair investigation.

The stocks took a severe beating and it wasn’t until May 2024 that all shares of Adani Group recovered the value lost 18 months earlir. Currently, Gautam Adani is estimated to have a net worth of $84 billion, according to Forbes.