How construction escrow helps keep payments safe from cybercrime

This audio is auto-generated. Please let us know if you have feedback.

Michael Stump is assistant vice president of commercial business development at Chicago-based Proper Title LLC.

Opinions are the author’s own.

Whenever significant amounts of money change hands, cyberfraudsters are always nearby trying to find a weak link in the process. This can be especially true with commercial real estate projects as there are a number of large payments being distributed — to engineers, architects, general contractors, subcontractors, material suppliers and many others.

In fact, according to ReliaQuest’s Q3 cyberthreat report, construction and manufacturing are among the top three targeted sectors for ransomware groups. And if you have worked in commercial real estate as long as I have, it’s natural to see why these sectors are so popular for cybercriminals — they share data and infrastructures with multiple companies.

One of the most common tactics thieves use in our industry is to impersonate construction companies via business email compromise to siphon funds. The perpetrator poses as a contractor and sends very realistic-looking, yet fraudulent, emails to the construction company’s clients instructing them to update their automated clearing house or direct deposit information and redirect the client’s payments from the legitimate construction company to the cybercriminals’ account.

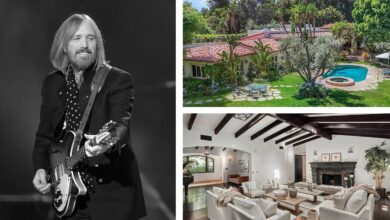

Michael Stump

Permission granted by Proper Title LLC

While there are different methods to avoid falling victim to cybercrime, one way those involved in a construction project — from lenders to developers to contractors — can be proactive in protecting their funds is to control payments via a construction escrow account. The reliable and safe disbursement of funds to contractors and suppliers upon the completion of each phase of a project is also key to keeping the project on schedule.

What is construction escrow?

Construction escrow accounts serve as a type of holding account for funds on a construction project and are typically set up by the developer’s lender or financial institution with a title company. The project owner can also establish a construction escrow account.

Funds are held in this account until work is complete and distributes payments to any contractors or suppliers throughout the duration of the construction project.

For an extra layer of oversight, contractors should look for a construction escrow manager that uses a “three-approval process.” The first step in this process is for the institution holding the construction escrow to gather all information in writing — where the money is to be sent, information about the recipient’s bank and a contact phone number.

Second, the holder of the construction escrow account calls the recipient to verify all the information. Yes, it’s an actual conversation and not simply an email.

Finally, after the wire transfer is sent, the construction escrow manager confirms with the contractor that the funds are in their account.

Developers and contractors should understand the process for making draws from the construction escrow account, the turnaround time, and the paperwork required to expedite the process. Typically, a contractor requests funds or a draw from the construction escrow account for the completed work and often an on-site inspection is performed to ensure the amount requested matches the work completed.

Once the application for funds is approved by the inspector and/or the owner, the construction escrow manager is notified, and the funds are released to the contractor. While construction escrow accounts are commonly used on financed projects, we encourage their use on any construction project as a means of additional oversight of project funds and as a guarantee that the owner has the money to fund the project.

Benefits of escrow

Contractors like construction escrow accounts because they guarantee the contractors will be paid. They can rest assured that funds are being held in an account before work starts and will be available for timely payment.

The construction escrow account can be set up once a construction loan closes. The lender then deposits the amount of the project contract into the construction escrow account, and funds are released as work is completed. Upon finalizing the process, the construction escrow agent obtains and logs the relevant contractor lien releases to avert title complications.

A construction escrow account can also help a developer manage its cash flow and keep projects on schedule because it is managed by a neutral third party focused on accuracy.

Commercial projects often entail multiple phases and typically require sizable construction loans, sometimes with layers of complicated financing. This results in large amounts of money being transferred to and from several parties.

Construction escrow accounts prove invaluable because they ensure the safe transfer of funds among contractors, suppliers, financiers and property holders.

The extra layer of protection construction escrow accounts provide in timely and accurate fund distribution to contractors also decreases the chance of lien claims being filed, which can quickly derail a construction project schedule. This in turn frees contractors to focus on completing the construction project without worries about payment.

Keeping payments secure

Managing construction escrow requires diligence on the part of the entity handling the service to identify common cyberfraud techniques such as social engineering, email spoofing, clone phishing, email hacking, imposter fraud and compromised accounts.

Construction escrow managers are experts at incorporating all the latest cybersecurity protocols such as scrutinizing email sender and domain names and double-checking ABA routing numbers and account numbers.

Verification phone calls are also made either in person or via a known, established phone number and not to a phone number listed in an email or found through a Google search. Construction escrow managers also must be aware of any new contractors hired midstream.

Whether you’re working on a tenant buildout or a new multimillion-dollar high-rise, setting up a construction escrow account can provide the security and reliability all parties involved need to complete a successful construction project.

Shirley Wrightsell, senior construction escrow consultant for Proper Title, LLC, contributed to this story.