IBM stock shrinks on paltry revenue growth

- IBM stock sinks nearly 7% on Q3 earnings miss.

- Revenue in third quarter missed Wall Street consensus by $110 million.

- Morgan Stanley lowers price target on IBM shares.

- Software was the only segment that grew from a year ago.

International Business Machines (IBM) flunked its latest test late Wednesday when the venerable tech company missed expectations for revenue in its third quarter. Shares plunged 6.7% midway through Thursday’s session, falling under $218 per share.

IBM’s pullback helped to send the Dow Jones Industrial Average (DJIA) back by half a percentage point by lunchtime, while the NASDAQ and S&P 500 both advanced moderately.

IBM stock earnings news

IBM reported $2.30 in adjusted earnings per share (EPS) on revenue of $14.97 billion. The profit was $0.07 ahead of Wall Street consensus, but revenue missed consensus by $110 million. Sales rose annually at 1.5%, below the rate of inflation.

The low level of revenue growth was frowned upon by the market, and management didn’t seem to think that it would change soon.

“Heading into the final quarter of 2024, we expect fourth-quarter constant currency revenue growth to be consistent with the third quarter, with continued strength in software,” said IBM CEO Arvind Krishna.

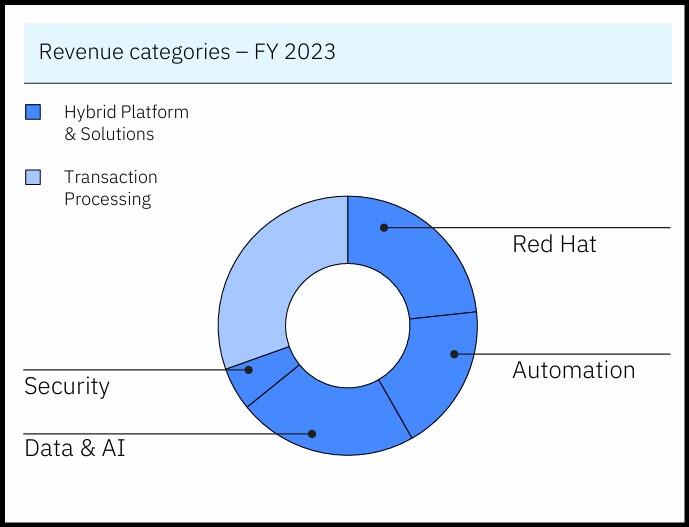

Software was the only major business segment to see growth, expanding nearly 10% YoY to $6.5 billion. The infrastructure, financing and consulting segments also saw sales drop from a year ago.

Morgan Stanley lowered its price target on IBM from $217 to $208.

“3Q revenue of $15B was 1% below Morgan Stanley estimates, driven by a 1% miss in Consulting and a 6% miss in Infrastructure, partially offset by a 1% beat in Software,” said a Morgan Stanley equity team led by analyst Erik Woodring.

IBM Q3 2024 presentation (IBM)

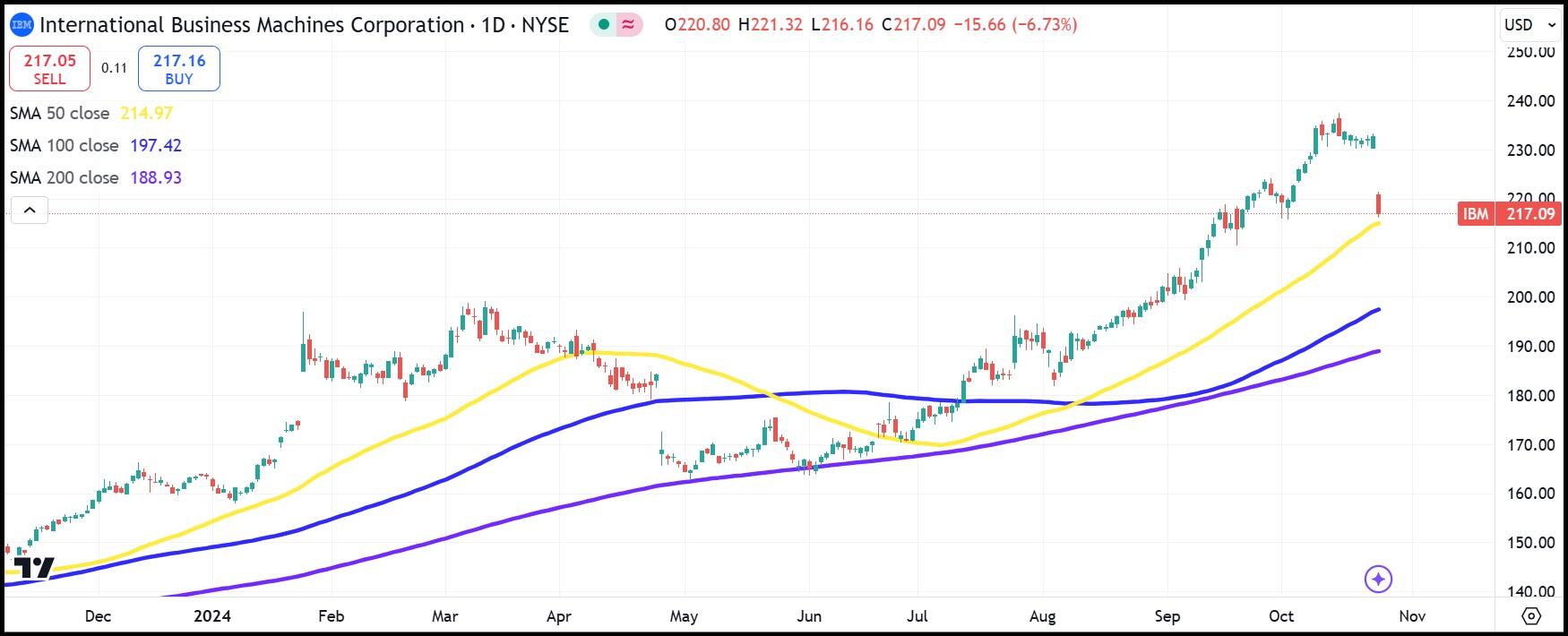

IBM stock forecast

IBM stock sank close to the 50-day Simple Moving Average (SMA) on Thursday. A break there near $215 would likely send IBM stock down to the 100-day SMA near $197.

IBM stock has already gained more than 32% this year, more than twice the 13.3% advance of the Dow Jones index, so a pullback is unsurprising. The $200 psychological level seems like a conceivable level for support. It served as resistance in March of this year, and then it was used as support in early September.

IBM daily stock chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.