Among unmarried adults, women without children have as much wealth as single men

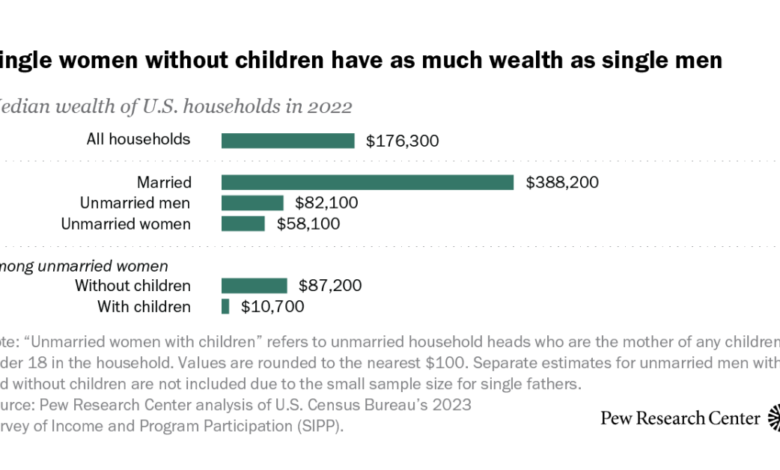

In the United States, households headed by married adults have much more wealth, on average, than those headed by single adults. And among unmarried adults, there’s a significant wealth gap between men and women.

In 2022, the typical single man had $82,100 in wealth, compared with $58,100 for the typical single woman, according to U.S. Census Bureau data.

Pew Research Center conducted this analysis to explore the gender wealth gap and identify some of the demographic factors at play.

This analysis is based on data from the U.S. Census Bureau’s 2023 Survey of Income and Program Participation (SIPP). In addition to details on the demographic characteristics of U.S. households, SIPP reports on households’ assets and liabilities (debt).

SIPP data on wealth refers to the December of the year preceding the survey date. For example, the 2023 SIPP has wealth estimates for 2022 based on households’ net worth as of Dec. 31, 2022.

The 2023 SIPP survey included more than 17,000 households. This sample is much larger than in the Federal Reserve’s Survey of Consumer Finances (SCF), which covered 4,595 families in 2022. Thus, unlike the SCF, SIPP makes it possible to analyze outcomes for smaller demographic groups, such as households headed by an unmarried mother with a child under 18.

The terms “single” and “unmarried” are used interchangeably in this analysis. Households whose head is living with an unmarried partner are classified as single. Households headed by an unmarried woman who is not the mother of any children under 18 are classified as “single women without children,” regardless of whether an unmarried partner has children in the household.

But among unmarried women, wealth varies considerably between those who have children under 18 in the household and those who don’t.

Households headed by unmarried women who do not have children under 18 had a median wealth of $87,200 in 2022 – similar to households headed by unmarried men. In contrast, the median wealth of households headed by unmarried women with children was $10,700.

(We cannot look at the wealth of households headed by unmarried men with or without children separately due to the relatively small number of single-father households.)

Gaps in specific household assets

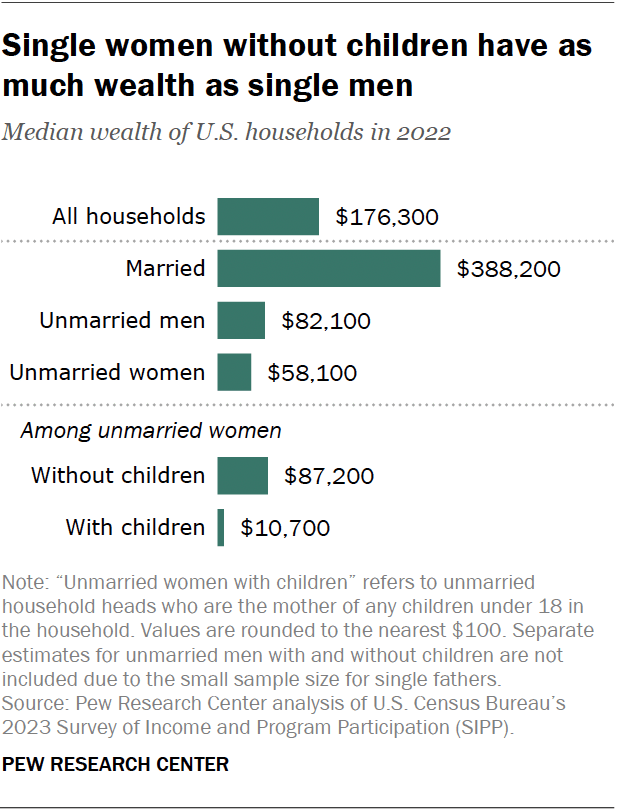

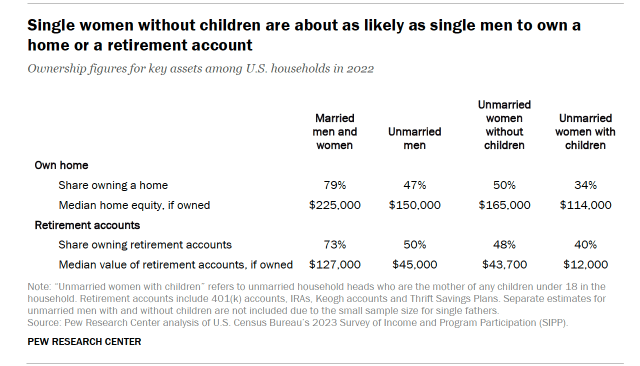

A household’s total wealth is the value of its assets minus its outstanding debts. Across key assets, unmarried women without children are about on par with unmarried men. Single women with children are behind in each area.

- Home ownership: In 2022, 50% of single women without children under 18 owned their home. This is similar to the 47% of unmarried men who owned their home. Only 34% of single mothers owned their home.

- Home equity: The typical single woman homeowner without children had $165,000 in home equity, which is the value of the home minus the outstanding mortgage balance. This is slightly more than the $150,000 median home equity of single men homeowners. Single mothers who own their home had $114,000 in median home equity.

- Retirement account ownership: Among household heads, 48% of single women without children and 50% of single men owned a retirement account (for example, a 401(k) account or IRA) in 2022. That compares with 40% of single mothers.

- Retirement savings: Unmarried women without a child who have a retirement account had a median amount of $43,700 in those accounts, not far below the $45,000 single men had accumulated. In contrast, the median amount in the retirement accounts of households headed by a single mother was $12,000.

How age contributes to wealth

On average, unmarried women tend to earn less than unmarried men. So how do unmarried women without children have similar wealth levels to unmarried men?

One big factor is age. Older household heads tend to have greater wealth than younger ones. And among heads of households, unmarried women without children are older, on average, than unmarried men.

The median age of single women without children heading a household is 61, compared with 50 for single men heading a household.

Once we account for age, single women without children don’t have the same wealth as single men. For example, among household heads younger than 65, the median wealth of unmarried women without children is $38,900, compared with $59,400 for unmarried men.

Age also plays a role in explaining the low wealth of households headed by unmarried women with children. The median age of household heads who are single mothers is 39.

Richard Fry is a senior researcher focusing on economics and education at Pew Research Center.