SMH Semiconductor ETF should continue pushing to the upside

The VanEck Semiconductor ETF (SMH) is an exchange-traded fund that tracks a market-cap weighted index composed of 25 of the largest U.S.-listed semiconductor companies. The top holdings of SMH include companies like NVIDIA, Taiwan Semiconductor Manufacturing, Broadcom Inc., Texas Instruments, QUALCOMM, ASML Holding N.V., Applied Materials, Inc., Lam Research Corporation, Micron Technology, Inc., and Advanced Micro Devices, Inc.

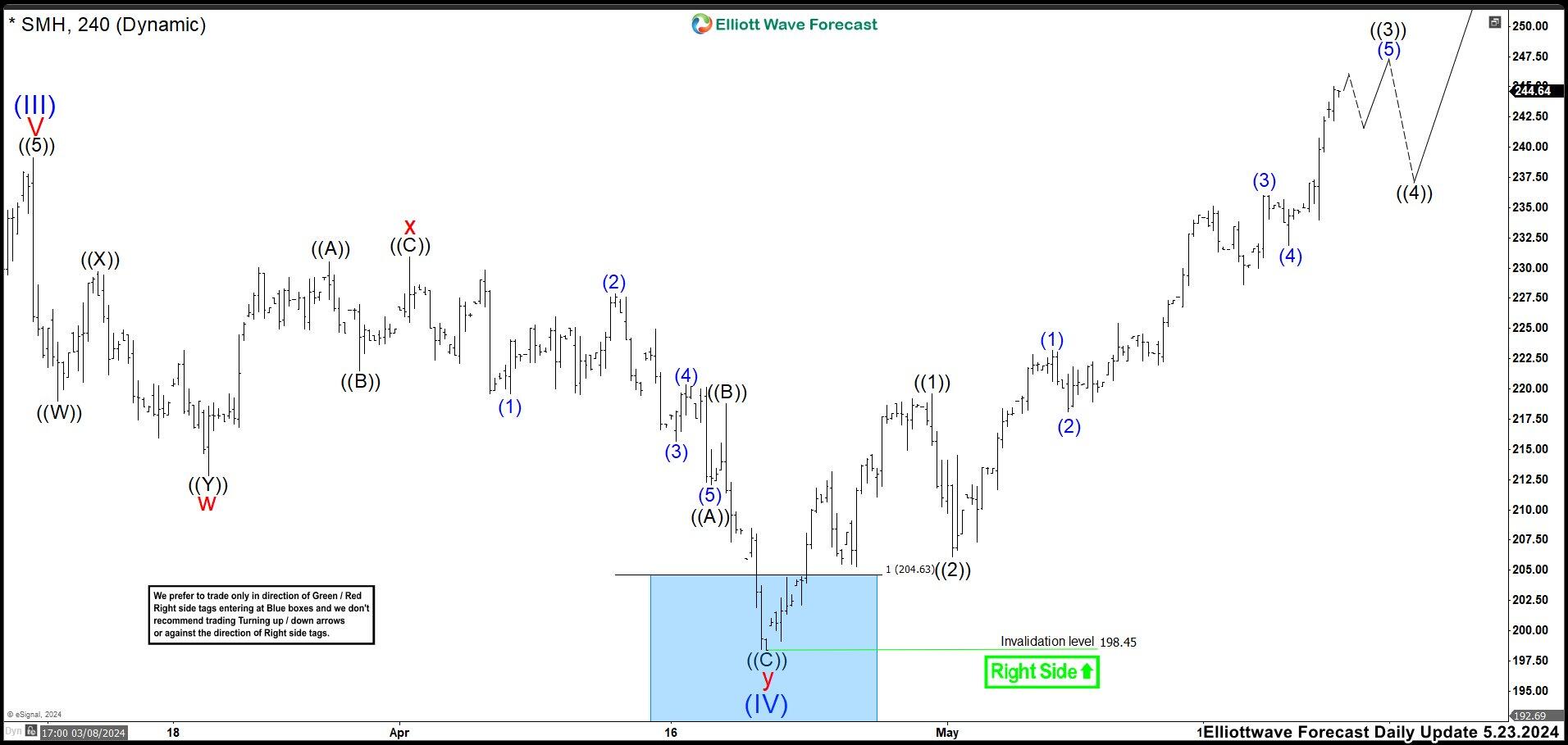

SMH four-hour chart May 23th

In May, we showed how SMH had reached the proposed blue box area. The idea was to look for buying opportunities in the zone to continue the upward movement. This correction ended a wave (IV) at 198.45 low and it had to continue with wave (V) that broke the peak of wave (III). In the chart, it can be seen that the market broke wave (III) high as we expected.

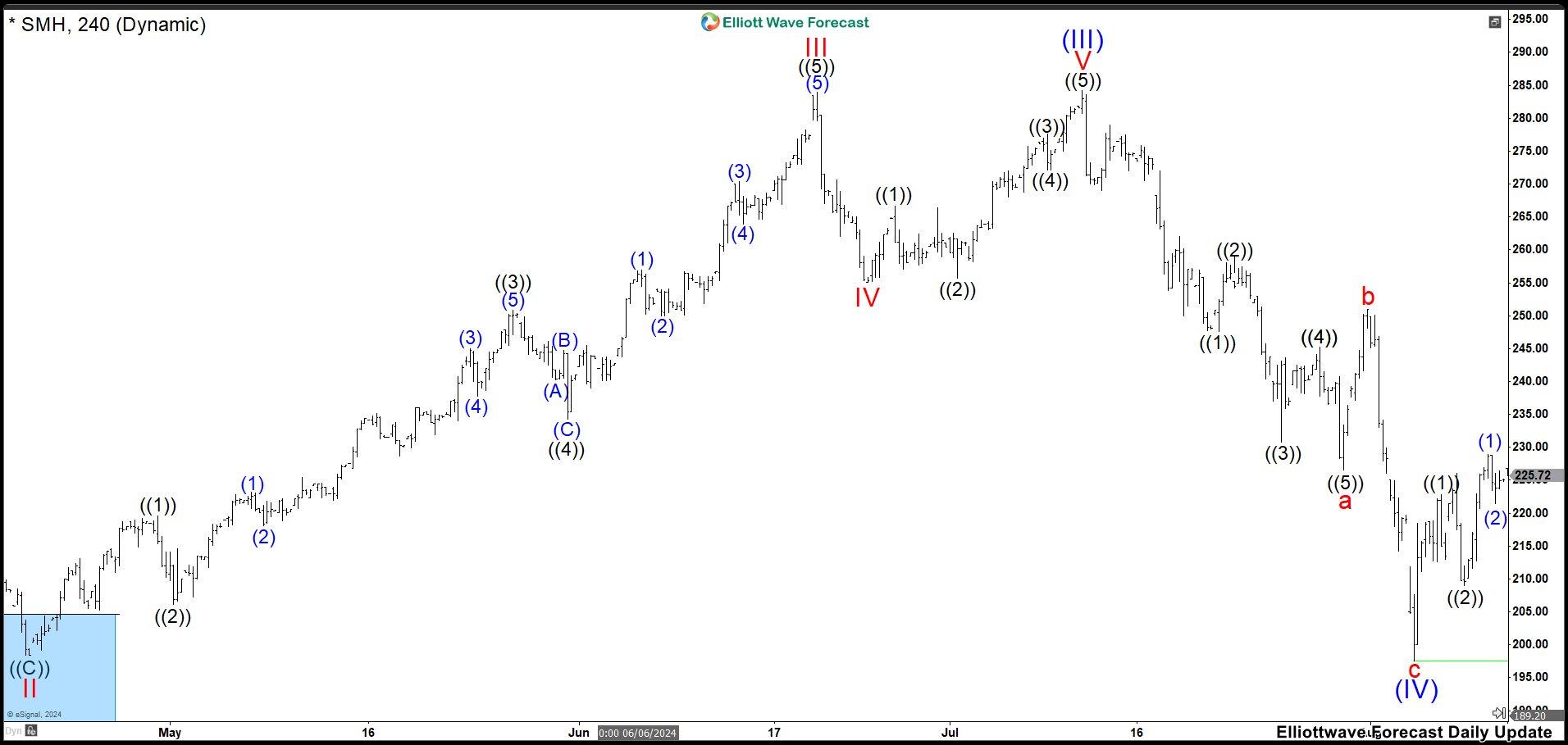

SMH four-hour chart blue box reaction

In the chart above, we can clearly see the market reaction from the blue box. We expected to reach as target the price of 265, giving us a profit of more than 29%; however, it reached as high as 284.26. This unexpected extension made us to adjust the count. Suggesting that SMH was still trading in wave (III). Therefore, what was wave (IV) became wave II and thus a wave (III) was formed ending at 284.26 high.

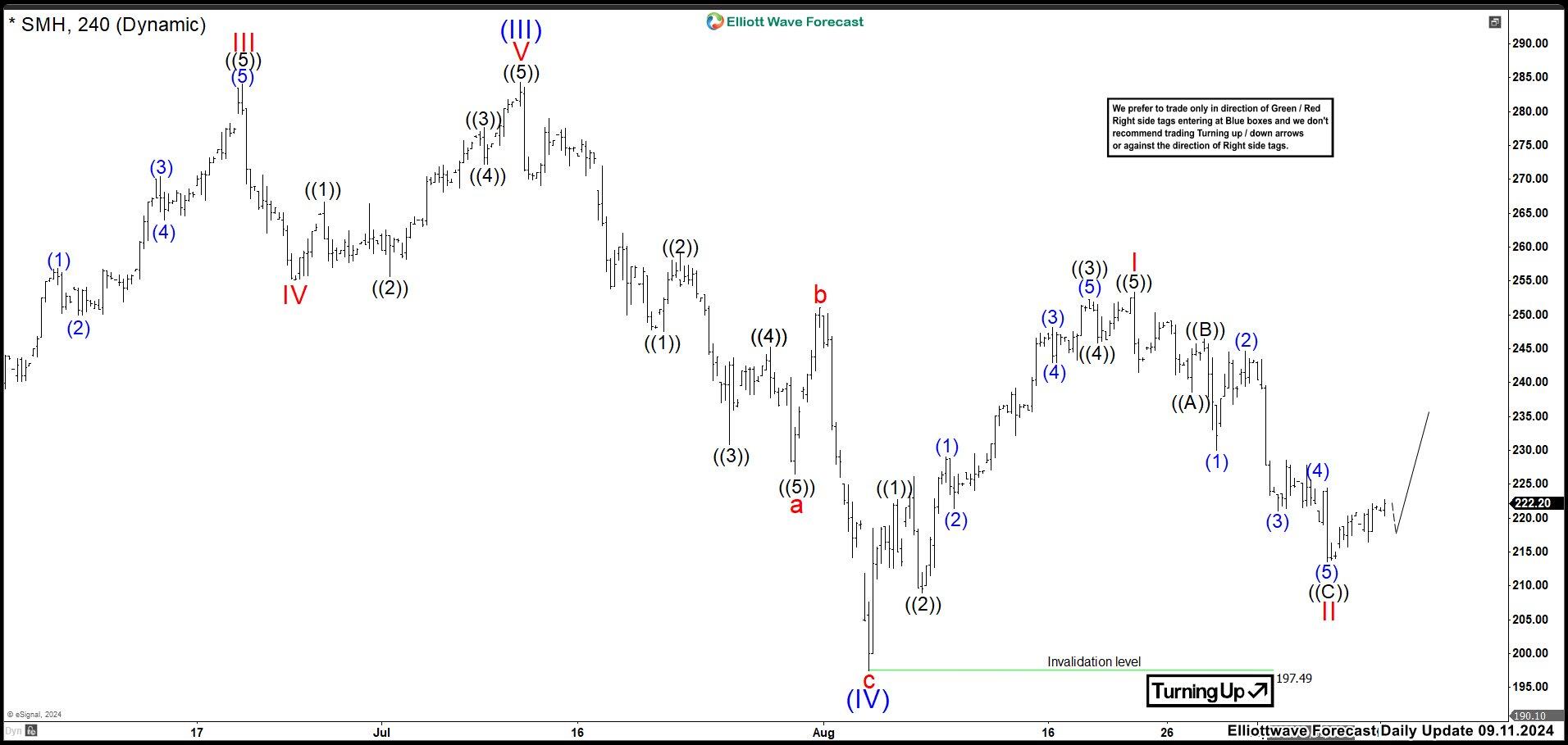

SMH four-hour chart September 11th

After completing wave (III), we had a deep pullback as a zig zag correction. Down from wave (III), wave “a”ended at 226.50 low and bounce as wave “b” ended at 251.00 high. Last push lower completed wave “c” and a wave (IV) at 197.50 low. Then, SMH started the uptrend again and wave (V). It built an impulse structure ending at 253.32 high as wave I. Pullback as wave II ended at 213.57 low. From here, we were expecting to continue the rally in wave III of (V). Ideally, the market should break 284.26 high as target to end wave (V). In case, if this rally does not break above wave (III), the next target to keep an eye comes around 269.50 level.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY

AND LIABILITY

Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk.

However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal,

analysis, or content.

Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on

the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s).

In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else.

Please understand and accept the risk involved when making any trading and/or investment decision.

UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization.

UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm

who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.