S&P BSE Sensex (India) Elliott Wave technical analysis [Video]

![S&P BSE Sensex (India) Elliott Wave technical analysis [Video]](https://us-news.us/wp-content/uploads/2024/07/53461-sp-bse-sensex-india-elliott-wave-technical-analysis-video-750x470.jpg)

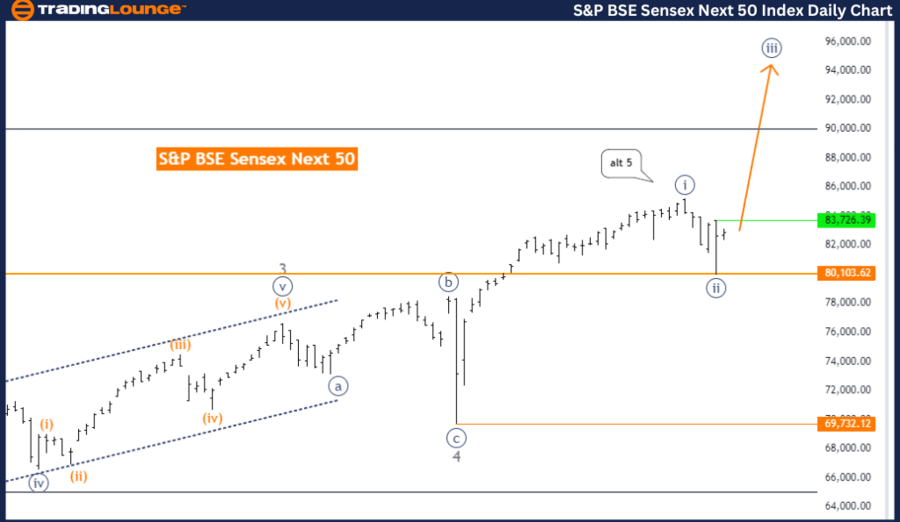

S&P BSE Sensex (India) Elliott Wave analysis – Day chart

Trend analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Navy blue wave 3.

-

Current position: Gray wave 5.

-

Direction for next higher degrees: Continuation of navy blue wave 3.

Detailed analysis

The S&P BSE Sensex (India) day chart, analyzed using Elliott Wave Theory, indicates a trending market. Currently, the market is in an impulsive mode, signifying strong directional price movements rather than corrective or sideways movements.

The primary structure under observation is the navy blue wave 3, part of an impulsive wave sequence. This phase is characterized by significant upward momentum, indicating a strong bullish trend. The market is presently in gray wave 5, typically the final wave in an impulsive sequence, suggesting an impending completion before a potential corrective phase.

Looking at the next higher degrees, the analysis projects the continuation of navy blue wave 3. This continuation indicates that even after the completion of gray wave 5, the broader bullish trend symbolized by navy blue wave 3 is expected to persist.

The detailed analysis notes that navy blue wave 2 of 5 appears complete, indicating that the market has concluded a corrective phase and is now entering the next impulsive phase, labeled as navy blue wave 3. This phase is anticipated to demonstrate strong upward price movements, furthering the overall bullish trend.

A critical component of this analysis is the wave cancellation invalid level, set at 69732.12. This level serves as a key threshold; if the market falls below this point, the current wave analysis would be invalidated, necessitating a reassessment of the wave structure.

Summary

The day chart analysis of the S&P BSE Sensex indicates the market is in an impulsive phase, specifically within navy blue wave 3, following the completion of navy blue wave 2 of 5. The ongoing momentum in navy blue wave 3 suggests continued bullish activity. The critical wave cancel invalid level is set at 69732.12, essential for validating the current wave analysis.

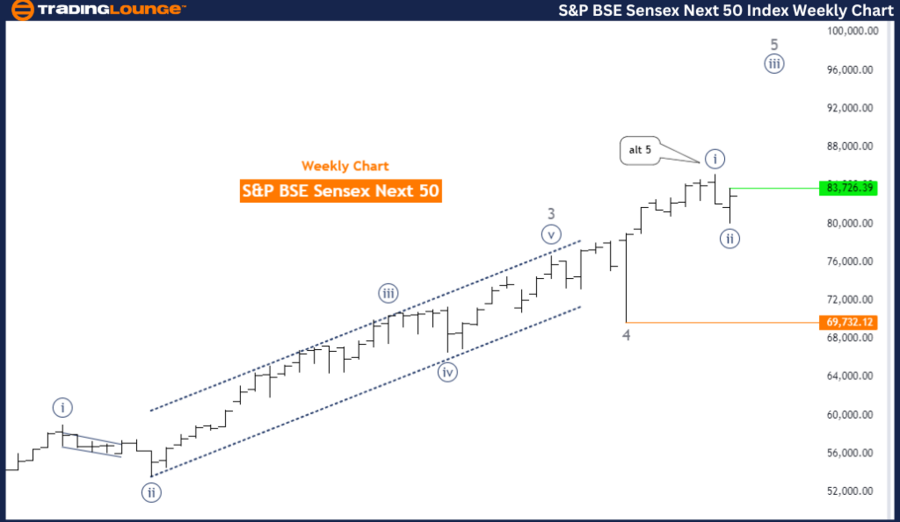

S&P BSE Sensex (India) Elliott Wave analysis – Weekly chart

Trend analysis

- Function: Trend

- Mode: Impulsive

- Structure: Navy blue wave 3

- Current Position: Gray wave 5

- Direction for Next Higher Degrees: Continuation of navy blue wave 3

Detailed analysis

The weekly chart of the S&P BSE Sensex (India), analyzed using Elliott Wave Theory, provides a comprehensive view of the market trends. The current market function is identified as a trend, indicating that the prevailing market direction is expected to persist. The wave is characterized as impulsive, signifying strong and directional price movements, as opposed to corrective or sideways movements.

The key wave structure under analysis is the navy blue wave 3, part of a larger impulsive sequence. This suggests the market is experiencing significant upward momentum. The current position within this sequence is gray wave 5, typically marking the final stage of an impulsive wave sequence before a potential corrective phase.

Looking at the next higher degrees, the analysis continues to point towards navy blue wave 3, indicating that even after the completion of gray wave 5, the overall bullish trend represented by navy blue wave 3 is expected to continue. This implies ongoing bullish momentum in the market.

The detailed analysis indicates that navy blue wave 2 of 5 has likely concluded. This completion suggests the market has ended a corrective phase and is now entering the next impulsive phase, designated as navy blue wave 3. This phase is characterized by strong upward price movements, reinforcing the overall bullish trend observed in the market.

A critical component of this analysis is the wave cancellation invalid level, set at 69732.12. This level acts as a key threshold; if the market price falls below this point, the current wave analysis would be invalidated, requiring a reassessment of the wave structure.

Summary

The weekly chart analysis of the S&P BSE Sensex indicates that the market is in an impulsive phase, specifically within navy blue wave 3, following the completion of navy blue wave 2 of 5. The continuation of navy blue wave 3 suggests sustained bullish momentum. The wave cancel invalid level is 69732.12, which is crucial for confirming the validity of the current wave analysis.

S&P BSE Sensex (India) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.