When Tested, Most Students Lack Financial Literacy, New Study Finds

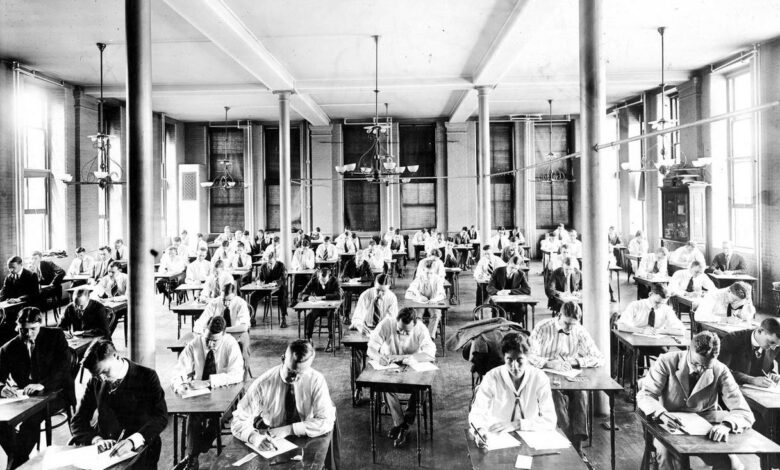

Candid photograph of students wearing suits sitting at desks taking an exam in a open room with tall … [+] windows and chandeliers at Johns Hopkins University, Baltimore, Maryland, 1950. (Photo by JHU Sheridan Libraries/Gado/Getty Images).

College has changed over the past few decades. That’s something that should be clear, even to casual observer.

Yet the majority of students still don’t have a grasp on basic financial matters, according to a recent research paper. The paper, titled Financial Literacy and Student Debt: Survey of College Students, found that overall the students surveyed did pretty badly in a six-question financial literacy test. The paper was authored by Hipolito Davila, and Jitka Hilliard, both from the department of finance at Auburn University, Alabama.

The results of testing the students were disappointing, to say the least. Fewer than three-out-of-20 (14.5%) got all six questions correct. And less than half (46.2%) scored four correct answers, the research shows.

The data comes from a survey of 31,000 students, primarily undergraduates, studying full time at a major public university in the South East U.S.

What is perhaps even worse. Is that those most in need of financial savvy did even worse than those who had taken out zero student debt. Those with no student loans got an average of 3.1 questions correct. Those with loans got 2.6 question right, on average, the paper shows.

Perhaps worse still is the lack of know-how from business studies students. They got an average of 3.0 questions correct, i.e half of the questions were right. Non business studies students did worse, getting 2.2 questions correct. The results showed.

The only good news here is that in 2013, over a decade ago, 3,357 Federal Reserve employees were given what looks like a similar test, but with a mere five questions. Only one third of the Fed employees got all five questions correct. That’s not great for what is supposed to be a powerhouse full of the best economists, but it was substantially better than the general population.

That research paper titled, Employee Financial Literacy and Retirement Plan Behavior: A Case Study, can be read here. It was authored by Robert Clark, Annamaria Lusardi and Olivia S. Mitchell.

For anyone interested in finance or business, the questions would seem to be relatively simple. Here are some examples of the questions the students faced taken directly from the research paper. (See bottom of the page for correct answers.)

Risk and diversification

Buying a single company’s stock usually provides a safer return than a stock mutual fund.

- a. True

- b. False

- c. Don’t know

- d. Prefer not to say

Bond price

If interest rates rise, what will typically happen to bond prices?

- a. They will rise

- b. They will fall

- c. They will stay the same

- d. There is no relationship between

- bond prices and interest rates

- e. Don’t know

- f. Prefer not to say

Compound interest

Suppose you owe $1,000 on a loan, and the interest rate you are charged is 20% per year compounded annually. If you didn’t pay anything off, at this interest rate, how many years would it take for the amount you owe to double?

- a. Less than 2 years

- b. At least 2 years but less than 5 years

- c. At least 5 years but less than 10 years

- d. At least 10 years

- e. Don’t know

- f. Prefer not to say

Mortgage

A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage, but the total interest paid over the life of the loan will be less.

- a. True

- b. False

- c. Don’t know

- d. Prefer not to say

Answers.

1. The bond price will fall 2. At least 2 years but less than 5 years 3. True, the total interest will be less on a 15 year mortgage