Will SEC Reject Bitcoin ETFs ? —Market Sentiment Index Provides Clues

Key Insights:

- Bitcoin’s (BTC) price fell nearly 10% on Wednesday, Jan 3 after a panic selloff set off massive liquidations in the derivatives markets.

- The panic selloff triggered a speculative research note suggesting that the SEC might reject the ongoing ETF applications.

- Bitcoin-weighted sentiment index provides clues into the dominant expectations among crypto investors, following Wednesday’s sell-off.

Bitcoin’s (BTC) price fell nearly 10% on Wednesday, Jan 3 following a panic selloff triggered by a a speculative research note suggesting that the SEC might reject the ongoing ETF applications. The latest market Sentiment Index readings provide clues on the dominant expectations among crypto investors, following Wednesday’s sell-off.

Do the market participants expect the SEC to reject Bitcoin ETFs in January 2024 or are those rumors largely unfounded.

Bitcoin Price Tumbled 10% Following Spot ETF Rejection Rumors

Bitcoin (BTC) sell-off on Wednesday has been attributed to a bearish research note published by Digital Asset management firm Matrixport. The speculative research note suggesting that the SEC might reject the ongoing ETFs applications.

With the SEC’s verdict anticipated by Jan 10, the rumor sent BTC holders into panic mode. Over $165 million BTC LONG positions were liquidated, resulting in 10% drop-off in market capitalization, all within 12 trading hours on Jan 3.

Despite Rumors Bitcoin Weighted-Sentiment Index Remains Elevated

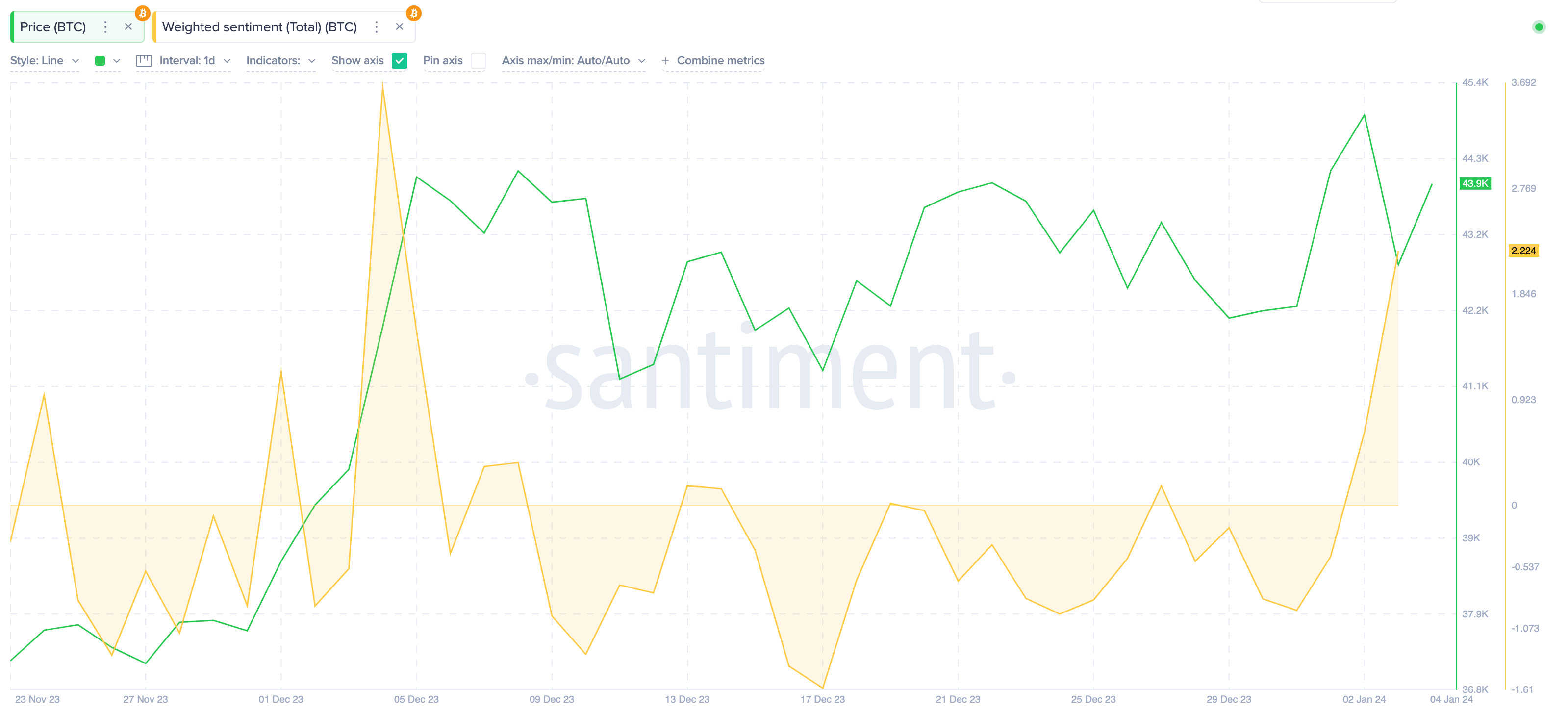

However, a critical on-chain metric now suggests that majority of investors have quickly shook off the rumors. Santiment’s weighted sentiment chart, is an on-chain metric that weighs the number of negative mentions about a particular assets against the negatives.

The latest reading, shows that BTC weight sentiment (yellow trendline) has increased well into the positive values within the last 24 hours. As depicted below depicted in the chart,

Bitcoin weighted-sentiment score stood at -0.91 on Dec 31. But following news of a the impending SEC verdict, it has now entered positive values, trending at 2.22 at press time on Jan 4.

When the number of postive statements exceeds negatives, the Weighted Sentiment index increase into positive values and vice-versa.

In effect, BTC weighted sentiment index trending at 2.22 means the number of positive comments surrounding Bitcoin have outnumbered the negatives, in the last 24 hours.

With the Spot Bitcoin ETF verdict dominating discussions surrounding the pioneer crypto asset, this is a clear indication that most market participants believe that a denial is unlikely.

In confirmation of the dominant positive sentiment, Bitcoin (BTC) price has since increased 7% from yesterday’s bottom price of $40,750 to reclaimed the $44,000 mark. At the time of writing, BTC was trading as high as $44,320 at the Eastern Time morning hours.