U.S. Recorded Music Revenue Topped $17 Billion in 2023 As Vinyl Sales Grew for the 17th Consecutive Year, Report Shows

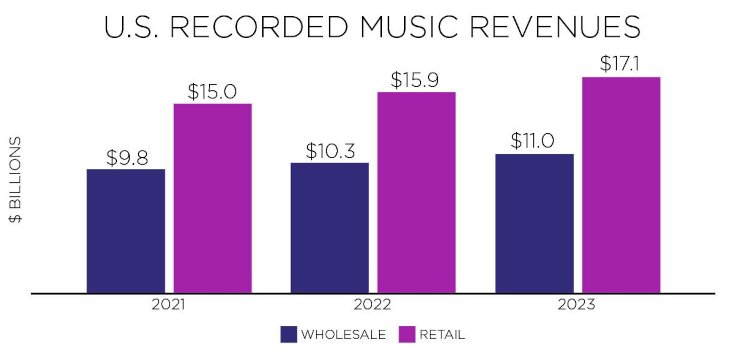

A breakdown of U.S. recorded music industry revenue by year, 2021-2023. Photo Credit: RIAA

The U.S. recorded music industry grew by 7.7% during 2023 on the strength of double-digit vinyl and paid streaming revenue expansions, according to a newly released report.

The Recording Industry Association of America (RIAA) today published its 2023 analysis of the domestic recorded music market, days following the IFPI’s report on the global industry.

According to the breakdown concerning the U.S., recorded music industry revenue last year totaled $17.12 billion at “estimated retail value” – not necessarily the prices that products actually fetched. As noted, the sum represents a close to 8% improvement from 2022.

And at wholesale value, the figure came in at about $11 billion for 2023, up approximately 7% from 2022, the trade organization disclosed. Notably, the above-highlighted IFPI report identified considerable overlap between the worldwide recorded music space as of 2022 and 2023; the top-10 markets remained exactly the same across the years.

Tying that broad point to the States, the RIAA communicated that 2023’s industry revenue was identical to 2022’s in terms of per-segment percentages. Streaming made up 84% of the market in both years, compared to 11% for physical, 3% for digital downloads, and 2% for sync as defined by the entity.

Digging into the numbers behind streaming in 2023, paid and ad-supported listening, on top of SoundExchange distributions and adjacent streaming revenue, delivered $14.36 billion at estimated retail value, the report shows.

Of course, the lion’s share of that sum came from paid listening ($10.15 billion, up 10.6% YoY) in 2023, when the average number of stateside paid subscriptions to Spotify, Apple Music, and others are said to have totaled 96.8 million (up 5.2 million YoY).

Rounding out the category, the RIAA pinpointed $1.02 billion in paid limited-tier streaming revenue (down 3.9% YoY), $1.86 billion from on-demand ad-supported streaming (up 2.3% YoY), just over $1 billion in SoundExchange distributions (up 4.7% YoY), and $317.7 million from “other ad-supported streaming” (up 21.5% YoY).

(The latter includes revenue “for statutory services that are not distributed by SoundExchange and not included in other streaming categories.”)

Predictably, permanent downloads’ years-running revenue decline continued in the U.S. during 2023, when fans spent $434.1 million in the category (down 12.2% YoY), the resource shows.

The two largest revenue contributors therein were single downloads ($190.8 million, down 10.9% YoY) and album downloads ($204.7 million, down 15.4% YoY).

Lastly, on the digital side, the RIAA attributed $410.9 million (up 7.4% YoY) to recorded sync licensing revenue for 2023. As we’ve long noted, however, a more comprehensive definition of sync, including UGC-platform licensing deals, indie placements, and a whole lot else, would produce a dramatically larger number.

Concluding with U.S. physical sales, 81.7 million vinyl and CD units were moved during 2023 (up 2.4% YoY), per the organization, for $1.91 billion in recorded revenue at estimated retail value (up 10.5% YoY). Despite a volume dip, CD revenue spiked 11.3% YoY to $537.1 million, against 10.3% for vinyl to $1.35 billion.

The latter format has now achieved stateside revenue growth for 17 consecutive years and, notwithstanding a volume slip in H1 2023, moved 2.7 million more units in 2023, for 43.2 million overall.