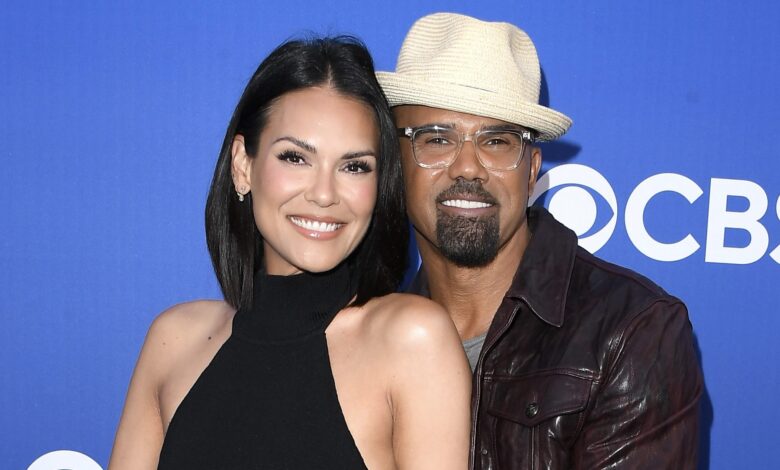

Whew! Shemar Moore Has Social Media Riled UP After Revealing He Why Doesn’t Plan On Marrying His Girlfriend

Whew! Roomies, Shemar Moore has social media riled UP after he recently revealed why he has no plans to marry his girlfriend and the mother of his only child, Jesiree Dizon.

RELATED: Congratulations! Shemar Moore, 52, Is Expecting His First Child With Model Jesiree Dizon, 39 (Video)

Shemar Moore Gets Candid About Not Wanting Marriage

On Thursday, November 14, PEOPLE published an exclusive interview with Moore where he candidly shared his thoughts on marriage. Moore explained that he views Dizon as his “partner in crime.” However, he’s “never seen marriage as part of his plan.”

“I didn’t have a good role model of marriage in my life. Not my mother, not my father. Nobody close to me. I struggle with ‘Who made that rule?’” he explained. “I asked my mother one time. I’m like, ‘If people get married, then what’s this prenup thing? Oh, I love you. You’re the most amazing person in the world but sign this. So you don’t trust the person?’”

Moore explained that he knows “tomorrow’s not guaranteed.” However, he plans on giving Dizon “everything [he’s] got today and tomorrow.”

“She is my partner. She is the mother of Frankie. Frankie has a dope-ass mama, and I’m going to try to be a dope-ass daddy,” Moore added before seemingly reiterating his preference to stay marriage-less. “And we going to do that until God calls my name.”

Until then, Moore explained that his main priority is to keep Dizon, their daughter, Frankie, and Dizon’s two children from previous relationships “safe.”

“I want to give her the best life. Not just material stuff. Just keep her safe. Keep them all safe. Kaiden, Charli, Frankie, Desiree. Kaiden has his daddy. I respect him. Charli has her daddy. I respect him. I don’t step on those toes, but I keep them safe. I mentor them as I can,” Moore said. “I try my hardest to make them believe in themselves and watch them fly.”

Social Media Reacts To The Actor’s Statement While Mentioning His Girlfriend Jesiree Dizon

Social media users reacted to Moore’s statements in The Shade Room’s comment section. Many appeared to be in disagreement with the actor’s outlook on marriage.

Instagram user @blackloveexists wrote, “You most likely didn’t have an example of millionaires in your life either…but you figured that out.”

While Instagram user @wassupnaijah added, “These men are embarrassing”

Instagram user @tessybeee wrote, “Marriage isn’t for everyone but this excuse is trash 😅”

While Instagram user @lifeandtimesjl added, “Then become it..”

Instagram user @ohyoutayy wrote, “so be the role model wtf ! what does that have to do with marrying someone you wanna be with”

While Instagram user @kjthejoker added, “Bruh as a man I say this respectfully… let that lady go find HER person . Smh 🤦🏾♂️”

Instagram user @kryssedeal wrote, “So why not be that role model??? It starts somewhere!”

While Instagram user @freespiritedchar added, “Translation: she’s not the one. They make up excuses when they don’t really want you.”

Instagram user @niyalaysia wrote, “He lost me.. why not get married and show Frankie what a healthy marriage looks like?!?!?”

While Instagram user @unemployed.mike added, “So you love her and she’s the mother of your child and that’s still not enough for you to marry her? 😂”

More Details On Shemar Moore & His Girlfriend Jesiree Dizon’s Journey In Parenthood

As The Shade Room previously reported, Moore and Dizon revealed they were expecting their first child together in January 2023.

Later that month, Dizon gave birth, per The Shade Room. Furthermore, Moore shared his reaction to his baby girl’s arrival with a post on Instagram.

“Ya boy is officially a Dad!!! Dreams come true!! The rest of my life is here! ❤️🙏🏽🙌🏽,” he wrote at the time.

Check out photos of Moore and Dizon’s family by swiping below.

RELATED: Shemar Moore Welcomes Daughter With Jesiree Dizon: “Dreams Come True!”

What Do You Think Roomies?