The Growth of Real Estate Investment in Opportunity Zones and Tax Incentives

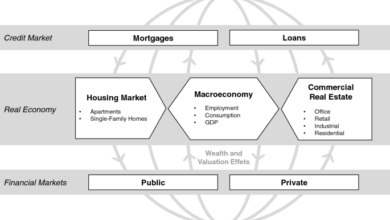

Real estate investment has always been an attractive option for those looking to diversify their portfolios, but with the introduction of Opportunity Zones and tax incentives, the industry has experienced significant growth in recent years. In this article, we will explore what Opportunity Zones are, how tax incentives have impacted real estate investment, and what the future looks like for this industry.

What are Opportunity Zones?

Opportunity Zones are designated areas in the United States that are identified as being economically distressed. These areas are eligible for tax incentives designed to encourage investment in the community. The Opportunity Zone program was created as part of the Tax Cuts and Jobs Act of 2017, with the goal of stimulating economic growth in areas that have been historically underserved.

How do Tax Incentives Impact Real Estate Investment?

The tax incentives associated with Opportunity Zones have had a significant impact on the real estate industry. One of the most notable benefits of investing in Opportunity Zones is the ability to defer capital gains taxes. This means that investors can reinvest capital gains from other investments into Opportunity Zone projects and defer paying taxes on those gains until 2026.

Another significant tax benefit is the potential for a reduction in capital gains taxes. If an investor holds an Opportunity Zone investment for at least 10 years, any capital gains realized from that investment are tax-free. This provides a powerful incentive for investors to hold onto their investments long-term, which can be beneficial for the community as well.

The Growth of Real Estate Investment in Opportunity Zones

Since the introduction of Opportunity Zones, real estate investment in these areas has grown significantly. According to a report by Real Capital Analytics, Opportunity Zone investments in the United States totaled $11.4 billion in 2020, up from $2.8 billion in 2019. This represents a growth rate of over 300%.

The growth in Opportunity Zone investment can be attributed to a variety of factors. One of the main reasons is the tax benefits associated with these investments, as discussed above. Additionally, many Opportunity Zone projects are located in areas with strong growth potential, which can be appealing to investors looking for high returns.

Challenges and Risks of Investing in Opportunity Zones

While Opportunity Zones offer significant benefits for investors, there are also some challenges and risks associated with these investments. One of the main risks is the fact that Opportunity Zone projects are often located in economically distressed areas. This can make it difficult for investors to find tenants or buyers for their properties, which can impact their returns.

Another challenge is the fact that there are limited regulations surrounding Opportunity Zone investments. This can make it difficult for investors to fully understand the risks associated with these investments and can lead to fraudulent schemes.

The Future of Real Estate Investment in Opportunity Zones

Despite the challenges and risks associated with Opportunity Zone investments, the future of real estate investment in these areas looks promising. The Biden administration has indicated that it plans to keep the Opportunity Zone program in place, although there may be some changes to the regulations surrounding these investments.

Additionally, as more investors become familiar with the benefits of Opportunity Zones, we can expect to see continued growth in real estate investment in these areas. This could lead to a revitalization of economically distressed areas and provide new opportunities for investors looking for high returns.

Conclusion

Real estate investment in Opportunity Zones has experienced significant growth in recent years, thanks in large part to the tax incentives associated with these investments. While there are challenges and risks associated with investing in Opportunity Zones, the potential for high returns and the opportunity to make a positive impact on economically distressed areas make these investments appealing to many investors. As the industry continues to grow, we can expect to see continued interest from investors and potential benefits for communities in Opportunity Zones.