The Future of Real Estate Development and Investment in Developing Countries

The future of real estate development and investment in developing countries is a topic of great importance and interest, given the significant economic growth and development that many of these countries are experiencing. Real estate development and investment are critical drivers of economic growth, as they provide a platform for job creation, infrastructure development, and increased access to housing and other essential amenities. This article explores the key trends and factors that are likely to shape the future of real estate development and investment in developing countries.

One of the key trends that are shaping the future of real estate development and investment in developing countries is the rapid urbanization that is taking place in many of these countries. According to the United Nations, more than half of the world’s population currently lives in urban areas, and this number is expected to grow to 68% by 2050. This presents a significant opportunity for real estate developers and investors, as they can capitalize on the growing demand for housing and other amenities in urban areas.

However, urbanization also presents significant challenges, particularly in developing countries. These challenges include inadequate infrastructure, high levels of poverty, and a lack of access to basic services such as healthcare and education. Real estate developers and investors must therefore take these challenges into account when planning and executing their projects.

Another key trend that is likely to shape the future of real estate development and investment in developing countries is the increasing focus on sustainability and environmental protection. As the effects of climate change become more apparent, there is growing awareness of the need to reduce carbon emissions and adopt sustainable practices in all areas of life, including real estate development.

Real estate developers and investors are responding to this trend by incorporating green building practices and technologies into their projects. This includes the use of renewable energy sources such as solar power, the implementation of energy-efficient building design, and the use of environmentally friendly building materials.

In addition to these trends, there are several factors that are likely to shape the future of real estate development and investment in developing countries. One of the most important of these factors is government policies and regulations. Governments in developing countries play a critical role in shaping the real estate sector by providing incentives for investment, regulating land use and development, and ensuring that basic infrastructure is in place.

However, government policies and regulations can also act as barriers to investment if they are overly restrictive or inefficient. Real estate developers and investors must therefore be aware of the regulatory environment in the countries where they operate and take steps to ensure compliance with applicable laws and regulations.

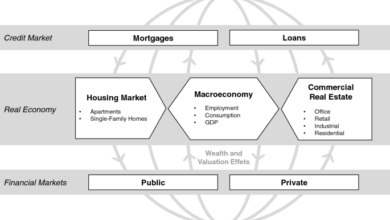

Another factor that is likely to shape the future of real estate development and investment in developing countries is the availability of financing. Access to finance is critical for real estate development, as projects typically require significant upfront capital investments. However, many developing countries have limited access to traditional sources of finance such as banks and other financial institutions.

To address this challenge, real estate developers and investors are turning to alternative sources of financing, such as crowdfunding, private equity, and real estate investment trusts (REITs). These sources of finance can provide developers and investors with access to capital while also offering investors the opportunity to participate in real estate projects in developing countries.

Finally, technological innovation is also likely to shape the future of real estate development and investment in developing countries. Advances in technology, such as the use of drones, virtual reality, and artificial intelligence, are already transforming the way that real estate projects are planned and executed.

For example, the use of drones for surveying and mapping can reduce the time and cost of site inspections, while virtual reality can provide investors and buyers with a more immersive and realistic experience of properties. Real estate developers and investors who are able to stay abreast of these technological developments are likely to have a competitive advantage in the market.

In conclusion, the future of real estate development and investment in developing countries is likely to be shaped by several key trends and factors, including rapid urbanization, sustainability, and environmental protection, government policies and regulations, access to financing, and technological innovation. While these trends and factors present significant challenges, they also offer opportunities for real estate developers and investors who are able to adapt to the changing landscape of the real estate sector in developing countries.

Real estate developers and investors who are able to embrace sustainability and green building practices, for example, will be well-positioned to meet the growing demand for environmentally responsible developments. Those who are able to navigate the regulatory landscape and secure access to financing will be able to bring their projects to fruition, while those who stay up-to-date with technological developments will be able to stay ahead of the curve in a rapidly evolving market.

At the same time, there are risks associated with real estate development and investment in developing countries that must also be taken into account. These include political instability, corruption, and the potential for economic downturns or market fluctuations. Real estate developers and investors must therefore approach investments in developing countries with caution and carefully assess the risks and rewards before committing capital to a project.

Overall, the future of real estate development and investment in developing countries is bright, with significant potential for growth and development. Real estate developers and investors who are able to navigate the challenges and capitalize on the opportunities presented by this rapidly evolving market will be well-positioned to succeed in the years to come.