The Future of Real Estate Financing and Investment Strategies

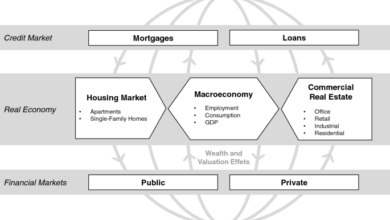

Real estate is an attractive investment for many people because it has the potential for long-term appreciation and a steady stream of income. However, traditional real estate financing and investment strategies are changing due to new technologies and market trends. In this article, we will explore the future of real estate financing and investment strategies and how these changes can impact investors.

Introduction

Real estate financing and investment strategies have evolved over the years. In the past, investors had limited options when it came to investing in real estate. They could buy a property outright or take out a mortgage to finance their investment. However, new technologies and market trends are changing the real estate industry, and investors have more options than ever before.

In this article, we will explore the current trends in real estate financing and investment strategies and the impact of technology on the industry. We will also discuss the future of real estate financing and investment strategies, including blockchain technology, crowdfunding, private equity real estate funds, and real estate investment trusts (REITs).

Current Trends in Real Estate Financing and Investment Strategies

Real estate investors are always looking for ways to improve their returns while minimizing their risks. One trend that has emerged in recent years is the use of leverage. Investors are using more debt to finance their investments, which can increase their returns but also exposes them to more risk.

Another trend in real estate financing and investment strategies is the rise of alternative investments. Alternative investments, such as crowdfunding and private equity real estate funds, offer investors new ways to invest in real estate without owning physical property.

Impact of Technology on Real Estate Financing and Investment Strategies

Technology is transforming the real estate industry, and financing and investment strategies are no exception. One significant impact of technology on real estate is the rise of online platforms. These platforms allow investors to connect with borrowers and invest in real estate projects without ever leaving their homes.

Another impact of technology on real estate financing and investment strategies is the use of data analytics. Investors can use data to make informed decisions about which properties to invest in and how much to invest.

Blockchain Technology and Real Estate

Blockchain technology has the potential to revolutionize the real estate industry. Blockchain can provide a transparent and secure way to transfer ownership of property and track transactions. This technology can reduce fraud and lower transaction costs.

Crowdfunding and Real Estate Investing

Crowdfunding has become a popular way for investors to finance real estate projects. Crowdfunding allows investors to pool their money together and invest in a project. This strategy allows investors to diversify their portfolios and invest in real estate projects they might not have access to otherwise.

Private Equity Real Estate Funds

Private equity real estate funds are another alternative investment option. These funds pool money from investors to buy and manage properties. Private equity real estate funds can provide higher returns than traditional real estate investments, but they also come with higher fees and risks.

Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are publicly traded companies that own and manage income-producing real estate properties. REITs provide investors with a way to invest in real estate without owning physical property. REITs are a popular investment option because they offer high dividends and diversification benefits.

Artificial Intelligence and Real Estate

Artificial intelligence (AI) is changing the way real estate investors make decisions. AI can analyze data from a variety of sources, such as property listings, transaction data, and economic indicators, to help investors identify investment opportunities and predict market trends.

One way AI is being used in real estate is through predictive analytics. Predictive analytics uses algorithms to analyze data and identify patterns that can help investors make informed decisions about where to invest. For example, predictive analytics can identify areas where property values are likely to increase, allowing investors to invest in those areas before prices rise.

AI is also being used to enhance the customer experience. Chatbots and virtual assistants can provide customers with personalized service and answer their questions in real time. This technology can improve the buying and selling experience for customers, which can lead to increased customer satisfaction and repeat business.

Conclusion

Real estate financing and investment strategies are changing due to new technologies and market trends. Investors have more options than ever before, including crowdfunding, private equity real estate funds, and REITs. Technology is also playing a significant role in the industry, with online platforms, data analytics, blockchain technology, and AI transforming the way investors make decisions.

Investors who want to succeed in the future of real estate investing should embrace these changes and stay informed about new trends and technologies. With the right strategies and tools, investors can take advantage of the opportunities presented by the changing real estate landscape.