The Impact of Climate Migration on Real Estate Markets and Investment Opportunities

Climate change has become a major concern worldwide, leading to significant changes in weather patterns, natural disasters, and global temperatures. These changes have resulted in the migration of people from areas affected by climate change, which has affected real estate markets and created new investment opportunities. In this article, we will explore the impact of climate migration on real estate markets and investment opportunities, including the challenges and opportunities for investors and how they can benefit from this trend.

Introduction

Climate migration is a global phenomenon that has resulted in the displacement of people due to climate change. Climate change affects people’s livelihoods, homes, and communities, leading to the need to migrate to areas that are less affected by climate change. This migration has resulted in significant changes in real estate markets, creating new investment opportunities and challenges.

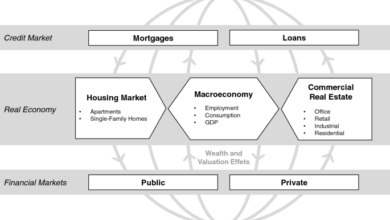

The Impact of Climate Migration on Real Estate Markets

Rising Demand for Housing in Safe Areas

As people migrate from areas affected by climate change, there is a rising demand for housing in safe areas that are less affected by climate change. This demand has led to an increase in real estate prices in these areas, making them a profitable investment opportunity.

Decline in Real Estate Prices in Affected Areas

Conversely, real estate prices in areas that are highly affected by climate change have declined due to the migration of people to safer areas. This has created opportunities for investors who are willing to take risks and invest in these areas with the hope of future growth.

Need for Resilient Real Estate

Climate change has also led to a need for resilient real estate that can withstand natural disasters and extreme weather conditions. This need has led to an increase in demand for green and sustainable buildings that are built to withstand extreme weather conditions. Investors can take advantage of this trend by investing in green and sustainable buildings that are resilient to climate change.

Investment Opportunities Arising from Climate Migration

Investment in Safe Areas

Investing in safe areas that are less affected by climate change is a profitable investment opportunity due to the rising demand for housing in these areas. Investors can take advantage of this trend by investing in real estate in safe areas with the hope of future growth.

Investment in Affected Areas

Investing in affected areas that have experienced a decline in real estate prices can be a risky but potentially rewarding investment opportunity. Investors who are willing to take risks can invest in these areas with the hope of future growth and profit.

Investment in Resilient Real Estate

Investing in green and sustainable buildings that are resilient to climate change is an emerging investment opportunity. As the demand for resilient real estate increases, investors can take advantage of this trend by investing in green and sustainable buildings that are built to withstand extreme weather conditions.

Challenges for Investors

Uncertainty about Future Climate Change

One of the main challenges for investors is the uncertainty about future climate change and its impact on real estate markets. Climate change is a complex phenomenon, and its impact on real estate markets is difficult to predict, making it challenging for investors to make informed investment decisions.

Regulatory and Legal Challenges

Investing in real estate also comes with regulatory and legal challenges that investors need to navigate. Regulations and laws related to environmental protection and sustainability can impact real estate investments, making it important for investors to stay informed and up-to-date.

Conclusion

Climate migration is a global phenomenon that has resulted in significant changes in real estate markets and created new investment opportunities. Investors can benefit from this trend by investing in safe areas, affected areas, and resilient real estate that can withstand extreme weather conditions. However, they also need to navigate challenges such as uncertainty about future climate change and regulatory and legal challenges. As climate change continues to affect people’s livelihoods and homes, real estate markets will continue to adapt to these changes, creating both challenges and opportunities for investors.