The Impact of Demographic Shifts and Aging Populations on Real Estate Markets

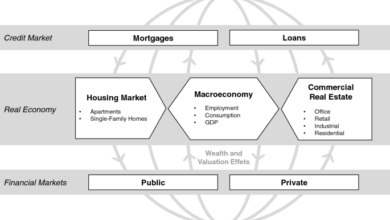

The impact of demographic shifts and aging populations on real estate markets is significant and multifaceted. As populations age, there are a number of changes that occur which can have both positive and negative impacts on the real estate market.

One of the most significant impacts of aging populations on real estate markets is the increase in demand for senior housing. As people age, they require specialized housing that meets their unique needs and preferences. This can range from retirement communities and assisted living facilities to nursing homes and other forms of long-term care. As a result, developers and investors are increasingly focused on developing and investing in these types of properties, which can drive up demand and prices in the senior housing market.

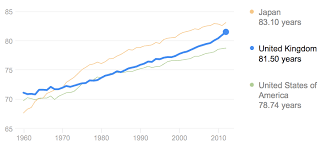

Another impact of aging populations on real estate markets is the changing demand for housing in general. As people age, they may choose to downsize their homes or move to more accessible properties that are easier to maintain. This can lead to a decrease in demand for larger, family-sized homes and an increase in demand for smaller, more manageable properties.

Demographic shifts can also impact the location of real estate markets. As younger generations move into cities and urban areas, there may be a shift in demand for housing away from suburban and rural areas. This can lead to a decline in demand and prices for properties in these areas while driving up demand and prices in urban areas.

Overall, the impact of demographic shifts and aging populations on real estate markets is complex and can vary depending on a number of factors, including location, property type, and local market conditions. However, it is clear that these demographic changes will continue to have a significant impact on the real estate market for years to come.

Another impact of aging populations on real estate markets is the potential for a slowdown in new home construction. As the population ages, there may be fewer households forming, which can lead to a decrease in demand for new housing. This, in turn, can lead to a slowdown in new construction activity, which can impact the local economy and job market.

On the other hand, there may also be opportunities for developers to renovate and repurpose existing properties to meet the changing needs of aging populations. For example, a large suburban home could be converted into a multi-generational living arrangement with separate living areas for an aging parent and their adult children and grandchildren. This type of repurposing could help meet the demand for more accessible, multigenerational housing options.

In addition, demographic shifts can impact the types of amenities and services that are in demand in certain real estate markets. For example, as the population ages, there may be an increased demand for healthcare facilities, senior centers, and other community resources that cater to the needs of older adults. Real estate developers and investors who can identify and respond to these changing demands can position themselves to take advantage of new opportunities in the market.

Overall, it is clear that demographic shifts and aging populations will continue to shape the real estate market in significant ways in the coming years. Developers and investors who are able to stay ahead of these changes and adapt to the evolving needs of the market will be well-positioned to succeed in this dynamic and evolving industry.