The Trend of Real Estate Investment in Energy Storage and Distribution Facilities

Real estate investment in energy storage and distribution facilities has become a growing trend in recent years. With the increasing demand for renewable energy sources and the need for energy storage solutions, investors are turning to these facilities as a potential investment opportunity. In this article, we will explore the trend of real estate investment in energy storage and distribution facilities, its benefits, and how investors can optimize their investments.

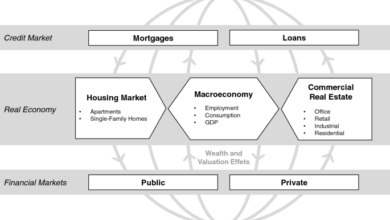

Firstly, let’s look at what energy storage and distribution facilities are. Energy storage facilities are designed to store energy for later use, typically during periods of high demand or when the energy supply is intermittent. These facilities store energy from renewable sources, such as solar or wind power, and can provide energy during peak demand periods, reducing the need for fossil fuel-powered generators. On the other hand, energy distribution facilities are responsible for transporting energy from the source to consumers, such as homes, businesses, and industries. These facilities are critical in ensuring that energy is delivered reliably and efficiently.

Investing in energy storage and distribution facilities can offer several benefits. Firstly, it provides a stable income stream, as energy consumption is essential in modern society. The increasing demand for renewable energy sources and the need for energy storage solutions means that the demand for these facilities is likely to grow in the future. Secondly, it can provide investors with a long-term investment opportunity, as energy storage and distribution facilities have a long lifespan and can generate income for several decades. Thirdly, investing in energy storage and distribution facilities can contribute to sustainability efforts, as it promotes the use of renewable energy sources and reduces greenhouse gas emissions.

To optimize their investment in energy storage and distribution facilities, investors need to consider several factors. Firstly, they need to evaluate the location of the facility carefully. The location should be in an area with high energy demand and close to the energy source, such as wind or solar farm. This will reduce transmission losses and ensure that the energy is delivered efficiently. Secondly, investors need to consider the type of energy storage technology used in the facility. The technology used should be reliable, efficient, and cost-effective. Thirdly, investors need to consider the regulatory framework in the region where the facility is located. This includes the permitting process, tax incentives, and other regulatory requirements.

Another important factor that investors need to consider is the financial viability of the project. Investors need to evaluate the financial projections carefully, including the projected revenue, expenses, and cash flows. They also need to consider the cost of capital and the expected rate of return. To optimize their investment, investors should conduct thorough due diligence, including an analysis of the market, competition, and risks associated with the project.

Furthermore, investors can consider partnering with established players in the energy storage and distribution industry to optimize their investments. Established players have the necessary expertise, experience, and resources to ensure that the project is successful. They can also provide access to a network of potential customers, suppliers, and investors.

In conclusion, the trend of real estate investment in energy storage and distribution facilities offers several benefits, including stable income, long-term investment opportunities, and contribution to sustainability efforts. To optimize their investment, investors need to consider several factors, including the location of the facility, the type of energy storage technology used, regulatory framework, financial viability, and potential partnerships. With the increasing demand for renewable energy sources and the need for energy storage solutions, investing in energy storage and distribution facilities can be a profitable and sustainable investment opportunity.