SpaceX is about to launch Starship again—the FAA will be more forgiving this time

Excitement still guaranteed —

SpaceX is about to launch Starship again—the FAA will be more forgiving this time

The FAA has approved a license for SpaceX’s fourth Starship launch, set for Thursday.

Enlarge / The rocket for SpaceX’s fourth full-scale Starship test flight awaits liftoff from Starbase, the company’s private launch base in South Texas.

SpaceX

The Federal Aviation Administration approved the commercial launch license for the fourth test flight of SpaceX’s Starship rocket Tuesday, with liftoff from South Texas targeted for just after sunrise Thursday.

“The FAA has approved a license authorization for SpaceX Starship Flight 4,” the agency said in a statement. “SpaceX met all safety and other licensing requirements for this test flight.”

Shortly after the FAA announced the launch license, SpaceX confirmed plans to launch the fourth test flight of the world’s largest rocket at 7:00 am CDT (12:00 UTC) Thursday. The launch window runs for two hours.

This flight follows three prior demonstration missions, each progressively more successful, of SpaceX’s privately-developed mega-rocket. The last time Starship flew—on March 14—it completed an eight-and-a-half minute climb into space, but the ship was unable to maneuver itself as it coasted nearly 150 miles (250 km) above Earth. This controllability problem caused the rocket to break apart during reentry.

On Thursday’s flight, SpaceX officials will expect the ascent portion of the test flight to be similarly successful as the launch in March. The objectives this time will be to demonstrate Starship’s ability to survive the most extreme heating of reentry, when temperatures peak at 2,600° Fahrenheit (1,430° Celsius) as the vehicle plunges into the atmosphere at more than 20 times the speed of sound.

SpaceX officials also hope to see the Super Heavy booster guide itself toward a soft splashdown in the Gulf of Mexico just offshore from the company’s launch site, known as Starbase, in Cameron County, Texas.

“The fourth flight test turns our focus from achieving orbit to demonstrating the ability to return and reuse Starship and Super Heavy,” SpaceX wrote in an overview of the mission.

Last month, SpaceX completed a “wet dress rehearsal” at Starbase, where the launch team fully loaded the rocket with cryogenic methane and liquid oxygen propellants. Before the practice countdown, SpaceX test-fired the booster and ship at the launch site. More recently, technicians installed components of the rocket’s self-destruct system, which would activate to blow up the rocket if it flies off course.

Then, on Tuesday, SpaceX lowered the Starship upper stage from the top of the Super Heavy booster, presumably to perform final touch-ups to ship’s heat shield, comprised of 18,000 hexagonal ceramic tiles to protect its stainless-steel structure during reentry. Ground teams were expected to raise the ship, or upper stage, back on top of the booster some time Wednesday, returning the rocket to its full height of 397 feet (121 meters) ahead of Thursday morning’s launch window.

The tick-tock of Starship’s fourth flight

If all goes according to plan, SpaceX’s launch team will start loading 10 million pounds of super-cold propellants into the rocket around 49 minutes before liftoff Thursday. The methane and liquid oxygen will first flow into the smaller tanks on the ship, then into the larger tanks on the booster.

The rocket should be fully loaded about three minutes prior to launch, and following a sequence of automated checks, the computer controlling the countdown will give the command to light the booster’s 33 Raptor engines. Three seconds later, the rocket will begin its vertical climb off the launch mount, with its engines capable of producing more than 16 million pounds of thrust at full power.

Heading east from the Texas Gulf Coast, the rocket will exceed the speed of sound in about a minute, then begin shutting down its 33 main engines around 2 minutes and 41 seconds after liftoff. Then, just as the Super Heavy booster jettisons to begin a descent back to Earth, Starship’s six Raptor engines will ignite to continue pushing the upper portion of the rocket into space. Starship’s engines are expected to burn until T+plus 8 minutes, 23 seconds, accelerating the rocket to near orbital velocity with enough energy to fly an arcing trajectory halfway around the world to the Indian Ocean.

All of this will be similar to the events of the last Starship launch in March. What differs in the flight plan this time involves the attempts to steer the booster and ship back to Earth. This is important to lay the groundwork for future flights, when SpaceX wants to bring the Super Heavy booster—the size of the fuselage of a Boeing 747 jumbo jet—to a landing back at its launch pad. Eventually, SpaceX also intends to recover reusable Starships back at Starbase or other spaceports.

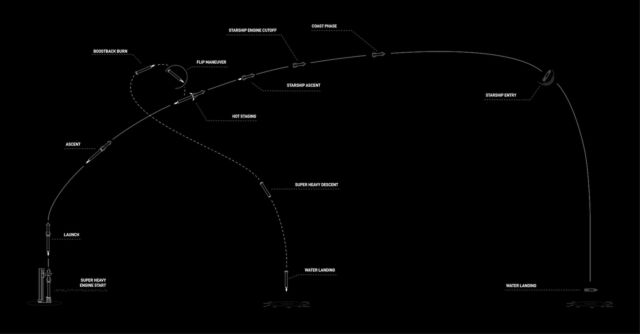

Enlarge / This infographic released by SpaceX shows the flight profile for SpaceX’s fourth Starship launch.

SpaceX

Based on the results of the March test flight, SpaceX still has a lot to prove in these areas. On that flight, the engines on the Super Heavy booster could not complete all the burns required to guide the rocket toward the splashdown zone in the Gulf of Mexico. The booster lost control as it plummeted toward the ocean.

Engineers traced the failure to blockage in a filter where liquid oxygen flows into the Raptor engines. Notably, a similar problem occurred on the second Starship test flight last November. The Super Heavy booster awaiting launch Thursday has additional hardware to improve propellant filtration capabilities, according to SpaceX. The company also implemented “operational changes” on the booster for the upcoming test flight, including jettison of the Super Heavy’s staging ring, which sits between the booster and ship during launch, to reduce the rocket’s mass during descent.

SpaceX has a lot of experience bringing back its fleet of Falcon 9 boosters. The company now boasts a streak of more than 240 successful rocket landings in a row, so it’s reasonable to expect SpaceX will overcome the challenge of recovering the larger Super Heavy booster.

The thorny issue of tiles

Starship, however, is a different animal. Despite having fewer engines, SpaceX’s ambitions for the ship require it to be immensely more complex than the booster. Ultimately, these goals for Starship include satellite deployments, interplanetary transport, landings on the Moon and Mars, and refueling in orbit. But first, SpaceX must show that Starship can reliably travel between Earth’s surface and low-Earth orbit.

On Flight 3 in March, the Starship upper stage lost the ability to control its orientation after turning off its main engines upon reaching space. SpaceX said engineers determined this was due to clogged valves used by reaction control thrusters on the upper stage, and the company said it is adding additional roll control thrusters on upcoming Starships.

The roll control problem prevented SpaceX from achieving two test objectives on the last Starship test flight. One was an attempt to reignite one of the ship’s Raptor engines in space, a capability that SpaceX must routinely use on future Starship flights. The other was the controlled reentry of the 165-foot-long (50-meter) upper stage. Without fully functioning thrusters, the ship fell back into the atmosphere in the wrong attitude, and SpaceX lost contact with the vehicle due to excess heating.

This time, SpaceX will try to keep it simple. Of course, simple is a relative term when it comes to spaceflight and Starship. On Flight 4, there’s no planned restart of a Raptor engine while the ship is in space. The lack of such a test on this flight means the next launch—Flight 5—will likely target a similar suborbital trajectory, rather than going all the way into orbit. Presumably, SpaceX, and perhaps federal regulators, would first like to see Starship prove it can execute a braking burn to return to Earth, rather than putting the vehicle into orbit and having it reenter the atmosphere unguided if the engine start failed.

This vehicle also doesn’t have a payload bay door like the last Starship opened and closed in space. Instead, the ship will drift through space until its flight path brings it back into the upper atmosphere around 47 minutes into the flight.

Enlarge / This rear-facing camera on Starship shows plasma building up around the vehicle during reentry over the Indian Ocean on the vehicle’s most recent test flight in March.

SpaceX

That’s when the ceramic tiles that make up Starship’s heat shield will get to work. The tiles, each about the size of a dinner plate, are similar in function to those used on NASA’s space shuttle, in that they insulate the ship’s primary structure from the blistering heat of reentry.

Elon Musk, SpaceX’s founder and CEO, wrote on X last week that gathering data on the tiles’ performance in flight is vital.

“This is a matter of execution, rather than ideas,” he wrote. “Unless we make the heat shield relatively heavy, as is the case with our Dragon capsule, where reliability is paramount, we will only discover the weak points by flying.”

In order to make real Musk’s lofty ambitions for a fully and rapidly reusable rocket, Starship’s heat shield must be resilient and require little in the way of refurbishment between flights. SpaceX has a long way to go there.

“Right now, we are not resilient to loss of a single tile in most places, as the secondary containment material will probably not survive,” Musk wrote. “This is a thorny issue indeed, given that vast resources have been applied to solve it, thus far to no avail.”

If it survives the heat of reentry, Starship will descend into the lower atmosphere belly first and decelerate to subsonic speed under the control of aerodynamic flaps, similar to miniature wings. Finally, the ship will reignite a subset of its Raptor engines—probably two—and quickly flip from horizontal to vertical to settle into the waters of the Indian Ocean between Madagascar and Australia. If this happens, cue the champagne.

Regulatory waivers

The FAA also made some changes with the launch license for SpaceX’s fourth Starship test flight that could speed up the process of issuing licenses for future launches.

With the first three Starship launches, the FAA license required SpaceX conduct a mishap investigation with federal oversight if the rocket failed to reach its destination intact. The outcome of the last test flight—Starship’s breakup over the Indian Ocean—triggered such an investigation by SpaceX.

The FAA is charged with ensuring public safety during commercial space launches and reentries. In a Starship mishap investigation, the agency’s role is to oversee the inquiry and accept the results of SpaceX’s investigation before issuing a license for the next launch.

But this approach isn’t congruent with SpaceX’s roadmap for Starship development. SpaceX’s iterative approach is rooted in test flights, where engineers learn what and what doesn’t work, then try to quickly fix it and fly again. A crash, or two or three, is always possible, if not likely. The FAA is making an adjustment for this week’s mission.

“As part of its request for license modification, SpaceX proposed three scenarios involving the Starship entry that would not require an investigation in the event of the loss of the vehicle,” the FAA said in a statement.

Based on language in the code of federal regulations, the FAA has the option to approve these exceptions. The FAA accepted three possible outcomes for the upcoming Starship test flight that would not trigger what would likely be a months-long mishap investigation.

These exceptions include the failure of Starship’s heat shield during reentry, if the ship’s flap system is unable to provide sufficient control under high dynamic pressure, and the failure of the Raptor engine system during the landing burn. If one of these scenarios occurs, the FAA will not require a mishap investigation, provided there was no serious injury or fatality to anyone on the ground, no damage to unrelated property, and no debris outside designated hazard areas.

This change is quite significant for the FAA and SpaceX. It shows that federal regulators, suffering from staffing and funding shortages, are making moves to try and keep up with SpaceX’s rapid, and often ever-changing, development of Starship.

“If a different anomaly occurs with the Starship vehicle, an investigation may be warranted, as well as if an anomaly occurs with the Super Heavy booster rocket,” the FAA said.