Mini-Neptune turned out to be a frozen super-Earth

Like Earth, but super —

The density makes it look like a water world, but its dim host star keeps it cool.

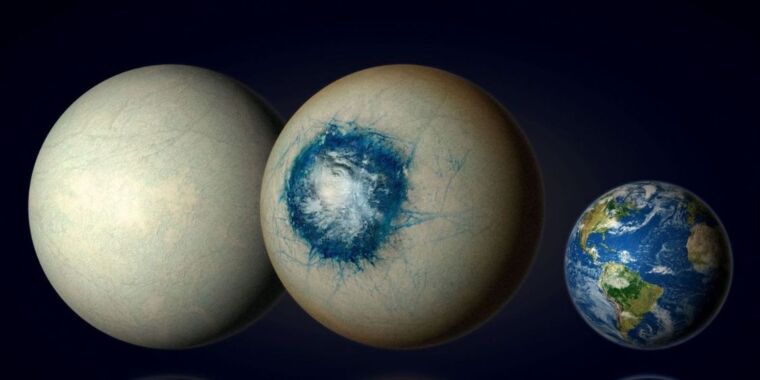

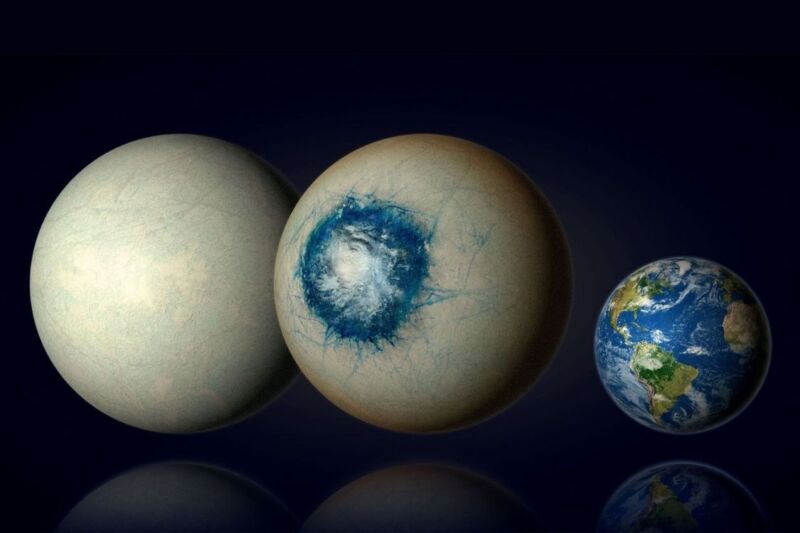

Enlarge / Renditions of a possible composition of LHS 1140 b, with a patch of ocean on the side facing its host star. Earth is included at right for scale.

Of all the potential super-Earths—terrestrial exoplanets more massive than Earth—out there, an exoplanet orbiting a star only 40 light-years away from us in the constellation Cetus might be the most similar to have been found so far.

Exoplanet LHS 1140 b was assumed to be a mini-Neptune when it was first discovered by NASA’s James Webb Space Telescope toward the end of 2023. After analyzing data from those observations, a team of researchers, led by astronomer Charles Cadieux, of Université de Montréal, suggest that LHS 1140 b is more likely to be a super-Earth.

If this planet is an alternate version of our own, its relative proximity to its cool red dwarf star means it would most likely be a gargantuan snowball or a mostly frozen body with a substellar (region closest to its star) ocean that makes it look like a cosmic eyeball. It is now thought to be the exoplanet with the best chance for liquid water on its surface, and so might even be habitable.

Cadieux and his team say they have found “tantalizing evidence for a [nitrogen]-dominated atmosphere on a habitable zone super-Earth” in a study recently published in The Astrophysical Journal Letters.

Sorry, Neptune…

In December 2023, two transits of LHS 1140 b were observed with the NIRISS (Near-Infrared Imager and Slitless Spectrograph) instrument aboard Webb. NIRISS specializes in detecting exoplanets and revealing more about them through transit spectroscopy, which picks up the light of an orbiting planet’s host star as it passes through the atmosphere of that planet and travels toward Earth. Analysis of the different spectral bands in that light can then tell scientists about the specific atoms and molecules that exist in the planet’s atmosphere.

To test the previous hypothesis that LHS 1140 b is a mini-Neptune, the researchers created a 3D global climate model, or GCM. This used complex math to explore different combinations of factors that make up the climate system of a planet, such as land, oceans, ice, and atmosphere. Several different GCMs of a mini-Neptune were compared with the light spectrum observed via transit spectroscopy. The model for a mini-Neptune typically involves a gas giant with a thick, cloudless or nearly cloudless atmosphere dominated by hydrogen, but the spectral bands of this model did not match NIRISS observations.

With the possibility of a mini-Neptune being mostly ruled out (though further observations and analysis will be needed to confirm this), Cadieux’s team turned to another possibility: a super-Earth.

An Earth away from Earth?

The spectra observed with NIRISS were more in line with GCMs of a super-Earth. This type of planet would typically have a thick nitrogen or CO2-rich atmosphere enveloping a rocky surface on which there was some form of water, whether in frozen or liquid form.

The models also suggested a secondary atmosphere, which is an atmosphere formed after the original atmosphere of light elements, (hydrogen and helium) escaped during early phases of a planet’s formation. Secondary atmospheres are formed from heavier elements released from the crust, such as water vapor, carbon dioxide, and methane. They’re usually found on warm, terrestrial planets (Earth has a secondary atmosphere).

The most significant Webb/NIRISS data that did not match the GCMs was that the planet has a lower density (based on measurements of its size and mass) than expected for a rocky world. This is consistent with a water world with a mass that’s about 10 to 20 percent water. Based on this estimate, the researchers think that LHS 1140 b might even be a hycean planet—an ocean planet that has most of the attributes of a super-Earth, but an atmosphere dominated by hydrogen instead of nitrogen.

Since it orbits a dim star closely enough to be tidally locked, some models suggest a mostly icy planet with a substellar liquid ocean on its dayside.

While LHS 1140 b may be a super-Earth, the hycean planet hypothesis might end up being ruled out. Hycean planets are prone to the runaway greenhouse effect, which occurs when enough greenhouse gases accumulate in a planet’s atmosphere and prevent heat from escaping. Liquid water will eventually evaporate on a planet that cannot cool itself off.

Though we are getting closer to finding out what kind of planet LHS 1140 b is, and whether it could be habitable, further observations are needed. Cadieux wants to continue this research by comparing NIRISS data with data on other super-Earths that had previously been collected by Webb’s Near-Infrared Spectrograph, or NIRSpec, instrument. At least three transit observations of the planet with Webb’s MIRI, or Mid-Infrared instrument, are also needed to make sure stellar radiation is not interfering with observations of the planet itself.

“Given the limited visibility of LHS 1140b, several years’ worth of observations may be required to detect its potential secondary atmosphere,” the researchers said in the same study.

So could this planet really be a frozen exo-earth? The suspense is going to last a few years.

The Astrophysical Journal Letters, 2024. DOI: 10.3847/2041-8213/ad5afa