Teen creates memecoin, dumps it, earns $50,000

dontbuy. Seriously, don’t buy it

Unsurprisingly, he and his family were doxed by angry traders.

On the evening of November 19, art adviser Adam Biesk was finishing work at his California home when he overheard a conversation between his wife and son, who had just come downstairs. The son, a kid in his early teens, was saying he had made a ton of money on a cryptocurrency that he himself had created.

Initially, Biesk ignored it. He knew that his son played around with crypto, but to have turned a small fortune before bedtime was too far-fetched. “We didn’t really believe it,” says Biesk. But when the phone started to ring off the hook and his wife was flooded with angry messages on Instagram, Biesk realized that his son was telling the truth—if not quite the full story.

Earlier that evening, at 7:48 pm PT, Biesk’s son had released into the wild 1 billion units of a new crypto coin, which he named Gen Z Quant. Simultaneously, he spent about $350 to purchase 51 million tokens, about 5 percent of the total supply, for himself.

Then he started to livestream himself on Pump.Fun, the website he had used to launch the coin. As people tuned in to see what he was doing, they started to buy into Gen Z Quant, leading the price to pitch sharply upward.

By 7:56 pm PT, a whirlwind eight minutes later, Biesk’s son’s tokens were worth almost $30,000—and he cashed out. “No way. Holy fuck! Holy fuck!” he said, flipping two middle fingers to the webcam, with tongue sticking out of his mouth. “Holy fuck! Thanks for the twenty bandos.” After he dumped the tokens, the price of the coin plummeted, so large was his single trade.

To the normie ear, all this might sound impossible. But in the realm of memecoins, a type of cryptocurrency with no purpose or utility beyond financial speculation, it’s relatively routine. Although many people lose money, a few have been known to make a lot—and fast.

In this case, Biesk’s son had seemingly performed what is known as a soft rug pull, whereby somebody creates a new crypto token, promotes it online, then sells off their entire holdings either swiftly or over time, sinking its price. These maneuvers occupy something of a legal gray area, lawyers say, but are roundly condemned in the cryptosphere as ethically dubious at the least.

After dumping Gen Z Quant, Biesk’s son did the same thing with two more coins—one called im sorry and another called my dog lucy—bringing his takings for the evening to more than $50,000.

The backlash was swift and ferocious. A torrent of abuse began to pour into the chat log on Pump.Fun, from traders who felt they had been swindled. “You little fucking scammer,” wrote one commenter. Soon, the names and pictures of Biesk, his son, and other family members were circulating on X. They had been doxed. “Our phone started blowing up. Just phone call after phone call,” says Biesk. “It was a very frightening situation.”

As part of their revenge campaign, crypto traders continued to buy into Gen Z Quant, driving the coin’s price far higher than the level at which Biesk’s son had cashed out. At its peak, around 3 am PT the following morning, the coin had a theoretical total value of $72 million; the tokens the teenager had initially held were worth more than $3 million. Even now, the trading frenzy has died down, and they continue to be valued at twice the amount he received.

“In the end, a lot of people made money on his coin. But for us, caught in the middle, there was a lot of emotion,” says Biesk. “The online backlash became so frighteningly scary that the realization that he made money was kind of tempered down with the fact that people became angry and started bullying.”

Biesk concedes to a limited understanding of crypto. But he sees little distinction between what his son did and, say, playing the stock market or winning at a casino. Though under California law, someone must be at least 18 years old to gamble or invest in stocks, the unregulated memecoin market, which has been compared to a “casino” in risk profile, had given Biesk’s teenage son early access to a similar arena, in which some must lose for others to profit. “The way I understand it is he made money and he cashed out, which to me seems like that’s what anybody would’ve done,” says Biesk. “You get people who are cheering at the craps table, or angry at the craps table.”

Memecoins have been around since 2013, when Dogecoin was released. In the following years, a few developers tried to replicate the success of Dogecoin, making play of popular internet memes or tapping into the zeitgeist in some other way in a bid to encourage people to invest. But the cost and complexity of development generally limited the number of memecoins that came to market.

That equation was flipped in January with the launch of Pump.Fun, which lets people release new memecoins instantly, at no cost. The idea was to give people a safer way to trade memecoins by standardizing the underlying code, which prevents developers from building in malicious mechanisms to steal funds, in what’s known as a hard rug pull.

“Buying into memecoins was a very unsafe thing to do. Programmers could create systems that would obfuscate what you are buying into and, basically, behave as malicious actors. Everything was designed to suck money out of people,” one of the three anonymous cofounders of Pump.Fun, who goes by Sapijiju, told WIRED earlier in the year. “The idea with Pump was to build something where everyone was on the same playing field.”

Since Pump.Fun launched, millions of unique memecoins have entered the market through the platform. By some metrics, Pump.Fun is the fastest-growing crypto application ever, taking in more than $250 million in revenue—as a 1 percent cut of trades on the platform—in less than a year in operation.

However, Pump.Fun has found it impossible to insulate users from soft rug pulls. Though the platform gives users access to information to help assess risk—like the proportion of a coin belonging to the largest few holders—soft rug pulls are difficult to prevent by technical means, claims Sapijiju.

“People say there’s a bunch of different stuff you can do to block [soft rug pulls]—maybe a sell tax or lock up the people who create the coin. Truthfully, all of this is very easy to manipulate,” he says. “Whatever we do to stop people doing this, there’s always a way to circumnavigate if you’re smart enough. The important thing is creating an interface that is as simple as possible and giving the tools for users to see if a coin is legitimate or not.”

The “overwhelming majority” of new crypto tokens entering the market are scams of one form or another, designed expressly to squeeze money from buyers, not to hold a sustained value in the long term, according to crypto security company Blockaid. In the period since memecoin launchpads like Pump.Fun began to gain traction, the volume of soft rug pulls has increased in lockstep, says Ido Ben-Natan, Blockaid founder.

“I generally agree that it is kind of impossible to prevent holistically. It’s a game of cat and mouse,” says Ben-Natan. “It’s definitely impossible to cover a hundred percent of these things. But it definitely is possible to detect repeat offenders, looking at metadata and different kinds of patterns.”

Now memecoin trading has been popularized, there can be no putting the genie back in the bottle, says Ben-Natan. But traders are perhaps uniquely vulnerable at present, he says, in a period when many are newly infatuated with memecoins, yet before the fledgling platforms have figured out the best way to protect them. “The space is immature,” says Ben-Natan.

Whether it is legal to perform a rug pull is also something of a gray area. It depends on both jurisdiction and whether explicit promises are made to prospective investors, experts say. The absence of bespoke crypto regulations in countries like the US, meanwhile, inadvertently creates cloud cover for acts that are perhaps not overtly illegal.

“These actions exploit the gaps in existing regulatory frameworks, where unethical behavior—like developers hyping a project and later abandoning it—might not explicitly violate laws if no fraudulent misrepresentation, contractual breach, or other violations occur,” says Ronghui Gu, cofounder of crypto security firm CertiK and associate professor of computer science at Columbia University.

The Gen Z Quant broadcast is no longer available to view in full, but in the clips reviewed by WIRED, at no point does Biesk’s son promise to hold his tokens for any specific period. Neither do the Pump.Fun terms of use require people to refrain from selling tokens they create. (Sapijiju, the Pump.Fun cofounder, declined to comment on the Gen Z Quant incident. They say that Pump.Fun will be “introducing age restrictions in future,” but declined to elaborate.)

But even then, under the laws of numerous US states, among them California, “the developer likely still owes heightened legal duties to the investors, so may be liable for breaching obligations that result in loss of value,” says Geoffrey Berg, partner at law firm Berg Plummer & Johnson. “The developer is in a position of trust and must place the interests of his investors over his own.”

To clarify whether these legal duties apply to people who release memecoins through websites like Pump.Fun—who buy into their coins like everyone else, albeit at the moment of launch and therefore at a discount and in potentially market-swinging quantities—new laws may be required.

In July 2026, a new regime will take effect in California, where Biesk’s family lives, requiring residents to obtain a license to take part in “digital financial asset business activity,” including exchanging, transferring, storing or administering certain crypto assets. President-elect Donald Trump has also promised new crypto regulations. But for now, there are no crypto-specific laws in place.

“We are in a legal vacuum where there are no clear laws,” says Andrew Gordon, partner at law firm Gordon Law. “Once we know what is ‘in bounds,’ we will also know what is ‘out of bounds.’ This will hopefully create a climate where rug pulls don’t happen, or when they do they are seen as a criminal violation.”

On November 19, as the evening wore on, angry messages continued to tumble in, says Biesk. Though some celebrated his son’s antics, calling for him to return and create another coin, others were threatening or aggressive. “Your son stole my fucking money,” wrote one person over Instagram.

Biesk and his wife were still trying to understand quite how their son was able to make so much money, so fast. “I was trying to get an understanding of exactly how this meme crypto trading works,” says Biesk.

Some memecoin traders, sensing there could be money in riffing off the turn of events, created new coins on Pump.Fun inspired by Biesk and his wife: QUANT DAD and QUANTS MOM. (Both are now practically worthless.)

Equally disturbed and bewildered, Biesk and his wife formed a provisional plan: to make all public social media accounts private, stop answering the phone, and, generally, hunker down until things blew over. (Biesk’s account is active at the time of writing.) Biesk declined to comment on whether the family made contact with law enforcement or what would happen to the funds, saying only that his son would “put the money away.”

A few hours later, an X account under the name of Biesk’s son posted on X, pleading for people to stop contacting his parents. “Im sorry about Quant, I didnt realize I get so much money. Please dont write to my parents, I wiill pay you back [sic],” read the post. Biesk claims the account is not operated by his son.

Though alarmed by the backlash, Biesk is impressed by the entrepreneurial spirit and technical capability his son displayed. “It’s actually sort of a sophisticated trading platform,” he says. “He obviously learned it on his own.”

That his teenager was capable of making $50,000 in an evening, Biesk theorizes, speaks to the fundamentally different relationship kids of that age have with money and investing, characterized by an urgency and hyperactivity that rubs up against traditional wisdom.

“To me, crypto can be hard to grasp, because there is nothing there behind it—it’s not anything tangible. But I think kids relate to this intangible digital world more than adults do,” says Biesk. “This has an immediacy to him. It’s almost like he understands this better.”

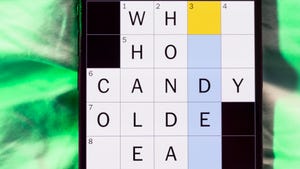

On December 1, after a two-week hiatus, Biesk’s son returned to Pump.Fun to launch five new memecoins, apparently undeterred by the abuse. Disregarding the warnings built into the very names of some of the new coins—one was named test and another dontbuy—people bought in. Biesk’s son made another $5,000.

This story originally appeared on wired.com.

Wired.com is your essential daily guide to what’s next, delivering the most original and complete take you’ll find anywhere on innovation’s impact on technology, science, business and culture.