The Rundown: Why Xbox easing up on console exclusivity could lead rivals to do the same

By Alexander Lee • February 16, 2024 • 6 min read •

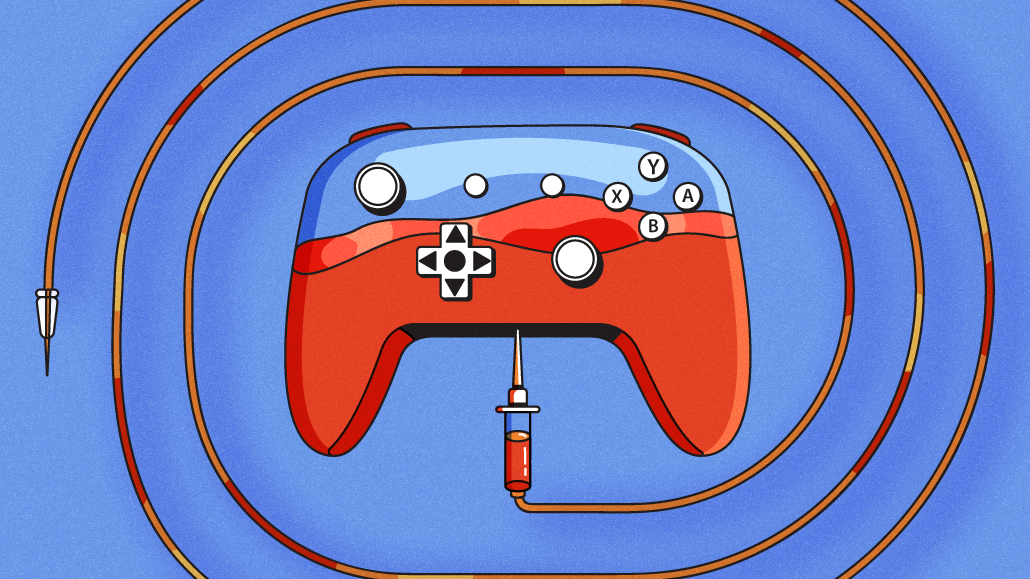

Ivy Liu

The Xbox brand is transforming — and the rest of the gaming industry is evolving alongside it.

On Feb. 15, Microsoft executives Phil Spencer, Sarah Bond and Matt Booty released an official podcast detailing the tech company’s current and future plans for the Xbox brand.

The crux of the announcement was that Xbox is planning to open up four previously exclusive titles to other gaming consoles such as the Sony PlayStation 5 and Nintendo Switch. Spencer, the CEO of Microsoft Gaming, declined to specify the four titles; reporting from The Verge has indicated that they will be “Sea of Thieves,” “Hi-Fi Rush,” “Pentiment” and “Grounded,” but Microsoft did not confirm this list.

Spencer and his colleagues framed the decision as the result of a gradual shift in the structure of the gaming industry that has occurred over the past few years. When reached for comment on the news, an Xbox representative directed Digiday to the podcast, as well as the company’s official blog post on the announcement.

“We’ve moved from a place where it used to be that someone built and launched a game to accelerate hardware, to actually, the things we do with our hardware and our platforms are all in service of making those games bigger,” said Bond, the president of Xbox, during the podcast.

Here’s a breakdown of what yesterday’s Xbox news says about the broader evolution going on within the gaming industry.

The key numbers

- Microsoft’s gaming business is booming so far in 2024, and the Xbox brand has been a significant contributor. Per the company’s Q2 2024 (which ran through Dec. 31) earnings call, Xbox content and services revenues — which includes revenue from the company’s popular Game Pass service — are up 61 percent year-over-year. But Xbox hardware sales lagged, increasing by only three percent amid a “weaker than expected console market,” according to Microsoft CFO Amy Hood during the January 30 call.

- In 2022, then-Xbox head Spencer told CNBC that Microsoft loses between $100 and 200 for every Xbox console sold, with the hope that console owners would eventually help the company recoup those costs through game purchases and subscriptions.

- Xbox sales have been buoyed in the past by the console’s spread of wildly popular exclusive titles, such as “Halo” and “Forza Horizon” — but in recent years, it has fallen behind PlayStation in the race for exclusive IP. By the end of 2022, Xbox hardware had only 59 exclusives, far behind the 286 available on the PlayStation.

- During the podcast, Bond confirmed that the number of Game Pass subscribers now stands at 34 million — a big jump from the 25 million subscribers reported by Microsoft when it announced its acquisition of Activision Blizzard in January 2022.

Sending a message

Some members of the gaming community have criticized Microsoft’s management of the Xbox brand in recent years, citing vague messaging about the brand’s future from its corporate overlords, as well as a general dissatisfaction with some of Microsoft’s premium games developed for the Xbox console.

“This feels like their last-chance opportunity to reverse a very long history of bad messaging,” said Pete Basgen, director of gaming and esports at media agency Wavemaker U.S. “I think we’re at a decade of pretty inconsistent messaging from Xbox, ever since the release of the Xbox One.”

Pivoting away from hardware

It’s no secret that live service and subscription business models are a rising tide within the gaming industry. While this is great news for products such as Xbox’s Game Pass, it represents a potential existential crisis for the major game developers that have historically been supported by premium game and hardware sales. At the moment, Xbox and PlayStation are cranking out record revenues, but the industry’s changing tides have made gaming executives increasingly nervous about their ability to grow these traditional profit drivers any further.

That’s why Xbox is dipping into its library of first-party IP to expand its business beyond console and premium game sales. Loosening its exclusivity rules could allow Microsoft to both build the cultural footprint of its most popular titles and increase the amount of eyeballs on them as it looks to step up its in-game advertising capabilities.

“I think it underscores a shift I’ve been seeing in the gaming community, where things are becoming a lot more open,” said John DeHart, director of business development for the gaming content creation platform Allstar. “Via public APIs, modding communities and porting, we are seeing companies across the entire ecosystem change their status quo on how they approach things.”

A downstream effect of the Activision Blizzard acquisition

To some extent, Microsoft’s decision to lean into its gaming intellectual property library — and transform the Xbox brand accordingly — is a result of the company’s successful closing of its Activision Blizzard acquisition last year. Now that Activision Blizzard is officially under the Microsoft umbrella, Microsoft has arguably leapfrogged Sony in the race for popular homegrown gaming IP, gaining access to fan favorites such as “Call of Duty,” “Overwatch” and even “Candy Crush.” When it comes to gaming IP, Microsoft is now king.

In spite of that newfound wealth of IP, the company has chosen four relatively smaller properties for its initial foray beyond exclusivity, rather than selecting a splashy name such as “Halo” or “Microsoft Flight Simulator.” Yesterday’s announcement represented a significant strategic shift for Microsoft, but not the death of the Xbox brand predicted by some online handwringers.

“For now, Xbox is only committing to making four of their games available for other consoles, although they did not reveal which games,” said Eli Ferrara, head of creative innovation for creative agency FCB. “I think this part was underwhelming for gamers who were looking forward to a bigger commitment toward ending console exclusivity.”

Ripples throughout the industry

In spite of recent criticisms of the brand, the Xbox remains a central pillar of the gaming community, and Microsoft’s opponents are taking note of the brand’s shift away from exclusivity. During Sony’s Q3 2023 earnings call on Feb. 14, company president Hiroki Totoki similarly cited multiplatform expansion as a potential growth area for PlayStation’s own intellectual properties.

“If you have strong first-party content, not only with our console, but also other platforms like computers, first-party [content] can be grown with multiplatforms, and that can help operating profits to improve,” Totoki said during the call.

Nintendo, Microsoft’s other big rival in the console wars, may also be adjusting its plans as a result of the recent shake-ups at Xbox. Industry insiders including veteran gaming journalist Jeff Grubb have suggested that the company has already moved its planned February Nintendo Direct event, potentially slated to reveal Nintendo’s Switch 2 console, to March in order to avoid muddying the waters with Xbox’s announcements yesterday.

https://digiday.com/?p=535107